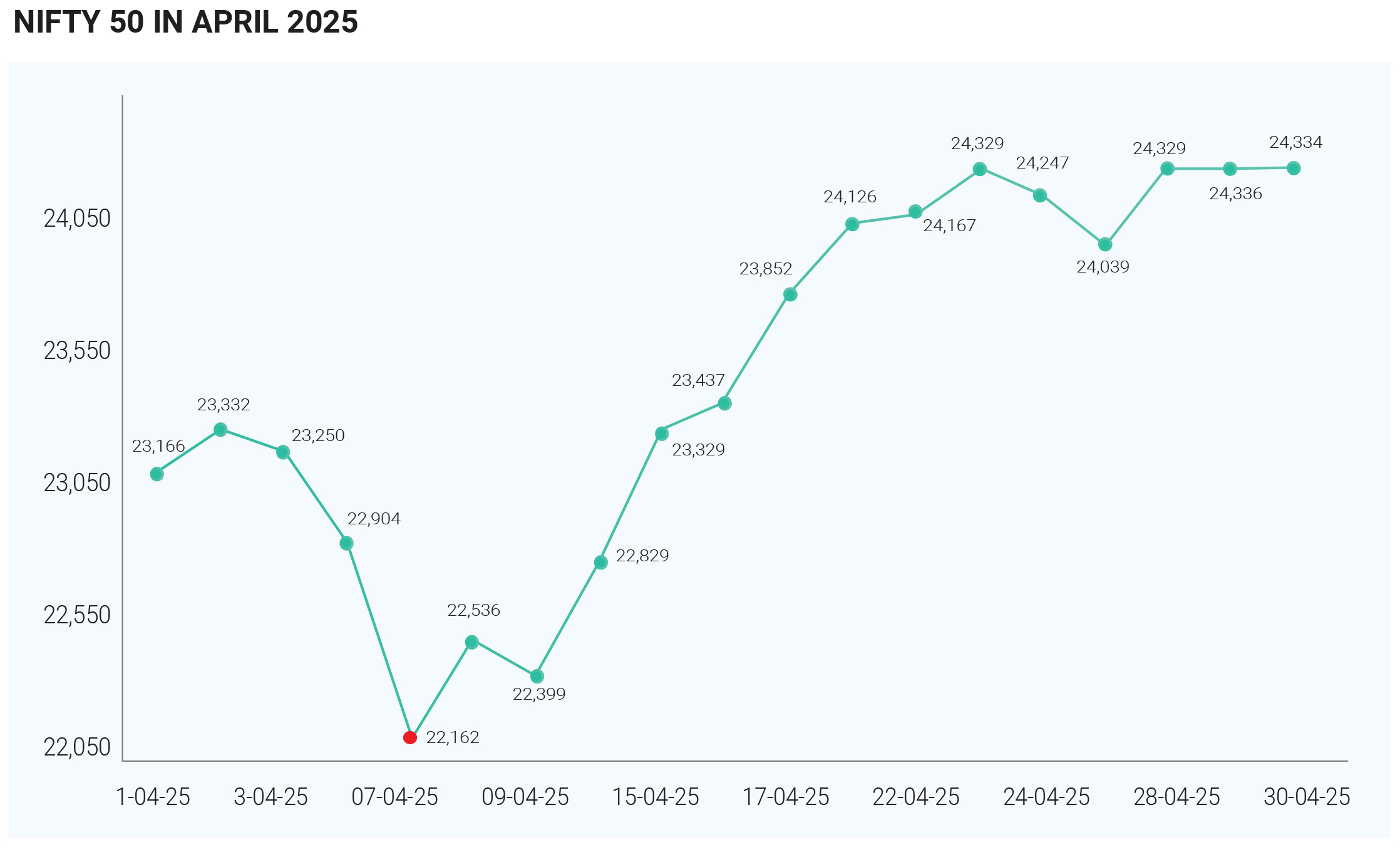

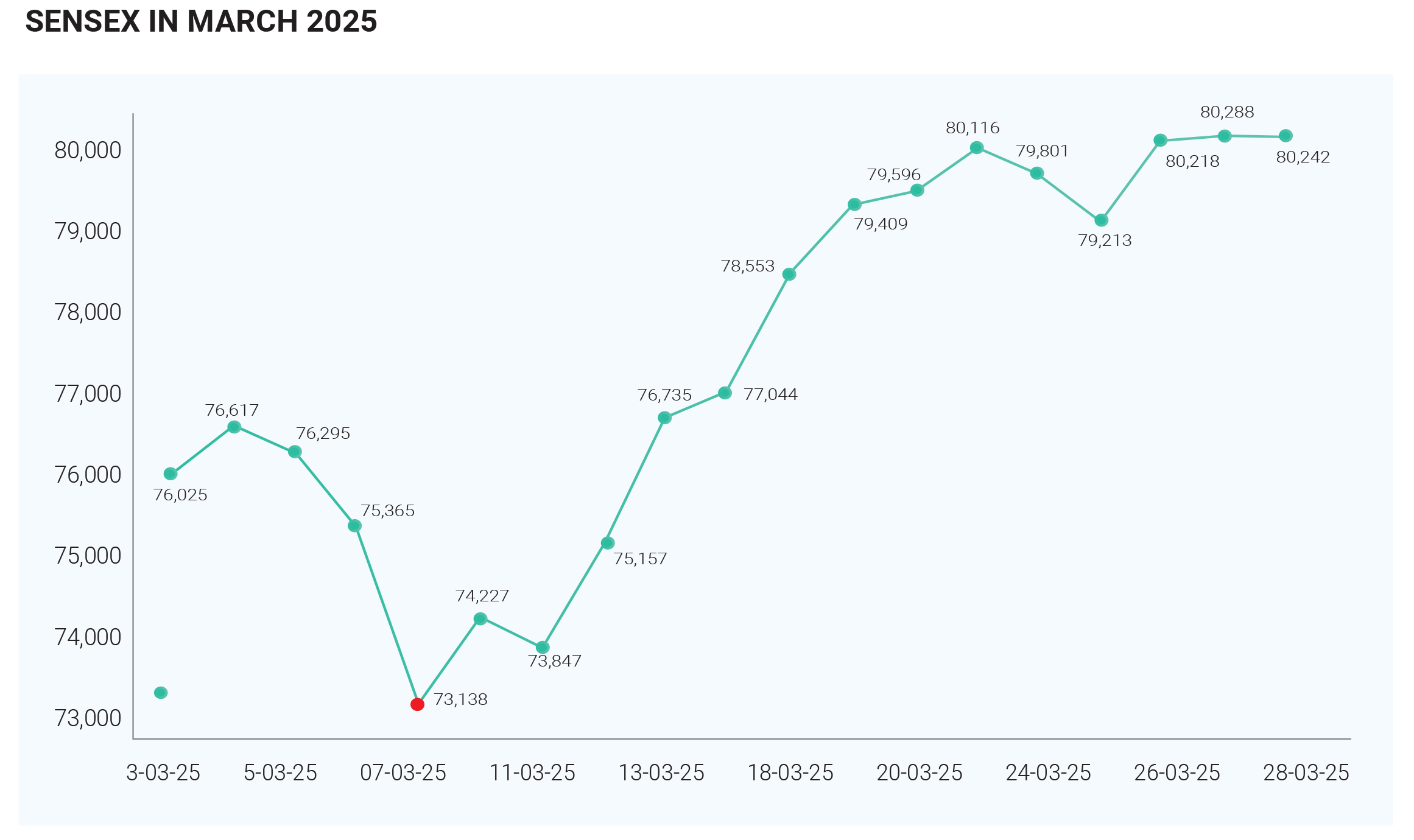

April 2025 proved to be a stellar month for Indian equity markets, with benchmark indices scaling record highs on the back of robust fundamentals and upbeat investor sentiment. The BSE Sensex surged from around 73,137 at the start of the month to close at 80,288 on April 29, marking one of its strongest monthly performances in recent times. Meanwhile, the Nifty 50 rallied from approximately 22,700 to end above 24,335, delivering a solid gain of over 6%.

The market rally was driven by a confluence of positive

factors. Strong corporate earnings across key sectors,

particularly banking, energy, and commodities,

reinforced investor confidence. Additionally, favourable

global cues—including steady economic data from major

economies and easing concerns around interest rate

hikes—helped sustain the bullish momentum.

A major catalyst behind April 2025’s remarkable market

rally was the sharp reversal in activity by Foreign

Institutional Investors (FIIs). After offloading over

₹40,000 crore in the first half of the month—amid global

tariff uncertainties and risk-off sentiment—FIIs staged a

dramatic comeback. In a striking turnaround, they poured

more than ₹38,000 crore into Indian equities during the

final 11 trading sessions, becoming aggressive buyers

and reigniting market momentum. This renewed inflow

was instrumental in propelling both the Sensex and Nifty

to record highs, with the indices registering over 10%

gains for the month. The FII shift was underpinned by a

weaker U.S. dollar, easing global trade tensions, and

growing optimism around India’s economic prospects,

including expectations of continued earnings growth and

macroeconomic stability

While FIIs stole the spotlight in April, Domestic

Institutional Investors (DIIs) played a crucial supporting

role—particularly during the first half of the month, when

they helped cushion the impact of FII outflows. However,

as foreign inflows surged in the latter half, DII

participation moderated, with some signs of profit

booking emerging. Overall, DII activity remained more

restrained compared to the aggressive stance taken by

FIIs, reflecting a cautious approach amid lofty valuations

and heightened geopolitical risks. Institutional activity

played a pivotal role in the rally. Both Foreign Institutional

Investors (FIIs) and Domestic Institutional Investors

(DIIs) remained net buyers throughout the month,

signalling broad-based conviction in India’s economic

growth prospects.

Robust Q4 FY25 earnings, particularly from heavyweight

corporates, played a central role in fuelling April’s market

rally. Leading the pack was Reliance Industries, whose

better-than-expected quarterly results triggered a sharp

surge in its stock price. As one of the index

heavyweights, Reliance’s rally had a significant positive

impact on broader market indices, reinforcing bullish

sentiment across the board. April’s sectoral performance

presented a diverse picture. Information Technology (IT)

and banking stocks emerged as the top performers,

buoyed by strong earnings and improved business

outlooks. The banking sector, in particular, benefited

from robust credit growth and healthy asset quality

trends. In contrast, pharma and metal stocks faced

headwinds, with some players seeing declines due to

margin pressures, regulatory concerns, and subdued

global demand. This divergence underscored the

market’s selective appetite, favouring sectors with clear

growth visibility and earnings strength.

In essence, April 2025 was a month of record-breaking

gains and strong investor optimism. With corporate

fundamentals remaining healthy and liquidity flows

intact, the Indian markets closed the month on a high

note, setting the stage for a potentially strong quarter

ahead

April 2025 was marked by falling bond yields, strong domestic support, and ample liquidity, even as foreign investors exited due to global yield movements and a narrowing India-US yield gap. India’s 10-year government bond yield fell sharply from around 6.6% at the start of April to about 6.33% by month-end, marking a drop of 23 basis points and reaching a three-year low. The decline was driven by RBI’s dovish policy, moderating inflation, strong liquidity support, stable government borrowing, favourable global trends, and foreign investor demand. The Reserve Bank of India cut its repo rate by 25 basis points and infused liquidity through open market operations, supporting lower yields and positive sentiment. Despite record foreign portfolio investor (FPI) outflows of $2.27 billion due to narrowing yield spreads with US bonds, local demand from banks and mutual funds remained robust, keeping borrowing costs low. Banking system liquidity shifted to surplus, averaging ₹1.4 lakh crore, further reinforcing bond market optimism. The yield curve steepened, with short- and medium-term yields falling more sharply than long-term yields. Steepening can affect government and corporate borrowing strategies. With higher supply of 10-year bonds and lower supply at the short end, investors may expect higher yields in the medium term, influencing portfolio allocations and borrowing costs. Comfortable liquidity conditions and strong demand for shorter-term bonds further reinforce expectations of stable or lower short-term rates, while increased 10-year supply puts upward pressure on longer-term yields. The Indian debt market is likely to extend its rally in May 2025, with lower yields, strong demand, and supportive central bank policy. With the easing of inflation, stable government borrowing, and global risk-off sentiment are tailwinds, though geopolitical risks remain.

April 2025 was a turbulent month for global energy markets, with crude oil prices plunging nearly 18% amid rising supply and weakening demand. Prices declined from $71.26 per barrel on April 1 to close the month at $58.36, reaching their lowest levels in over four years. From supply-side shocks to waning demand and deteriorating sentiment. There are several key factors contributed to this sell-off. In a surprising move, OPEC+ ramped up production, adding over 800,000 barrels per day across two months. This accelerated supply increase raised fears of a renewed oversupply glut, just as the global economy showed signs of fragility. The reemergence of U.S.–China trade tensions significantly rattled markets. The imposition of new tariffs by the U.S., followed by swift retaliatory measures from China, rekindled concerns of a global slowdown, casting a shadow over future oil demand. Economic data painted a sobering picture: slowing growth across the U.S., China, and the European Union, with the U.S. economy contracting in Q1 2025. These developments further eroded expectations for energy consumption, dragging down crude prices. Adding to the bearish tone were unexpected builds in U.S. crude oil inventories, which indicated softer domestic demand. The inventory overhang added downward pressure and reinforced concerns of supply-demand imbalance. As crude prices breached key technical levels, algorithmic and momentum-based selling kicked in, amplifying the decline. Heightened volatility and negative market sentiment turned a steady drop into a sharp sell-off. To summarise, April’s oil price collapse was fuelled by a toxic mix of oversupply, geopolitical strain, weak global demand, rising inventories, and market panic—a clear reminder of the oil market's sensitivity to both fundamentals and sentiment.

April 2025 was a rollercoaster month for the bullion market, marked by record highs, sharp reversals, and diverging trends between gold and silver. Amid global uncertainty, both metals saw significant investor interest, though gold grabbed the spotlight with historic price action. Gold prices soared to a record high of $3,500 per ounce mid-April as investors flocked to safe-haven assets. The rally was fuelled by a mix of geopolitical tensions, central bank buying—led by China—weakening U.S. Treasury yields, and a softening U.S. dollar. Domestically, 24K gold briefly crossed ₹10,000 per gram, an all-time high in several Indian cities. However, the rally was short-lived. As strong U.S. jobs data tempered expectations of early Fed rate cuts and Treasury yields rebounded, gold saw a sharp correction, falling to around $3,250 globally and ₹9,800 per gram in India by month-end. The retreat was also driven by technical selling, profit booking, and a cautious market mood ahead of Akshaya Tritiya. Despite the pullback, gold remained substantially up year-to-date, underscoring its ongoing appeal in uncertain times. Silver tracked gold’s trajectory but with more resilience in the second half of the month. By the end of April, silver was trading near $32.5 per ounce internationally and around ₹100,400 per kg in India, reflecting steady gains. Silver's strength was driven by a surge in industrial demand, particularly from the green energy, EV, 5G, and semiconductor sectors. It also benefited from its traditional role as a safe-haven and inflation hedge, as well as its relative undervaluation compared to gold. Supply concerns and currency depreciation further lifted domestic prices. While the gold-silver ratio remained elevated, silver outperformed gold in the latter half of April, supported by solid fundamentals and a more stable demand outlook. April highlighted the volatile nature of the bullion market, where sentiment, geopolitics, and macroeconomic signals can swiftly shift the narrative. With central bank demand strong, geopolitical tensions unresolved, and industrial use cases for silver expanding, both metals remain key assets to watch in the coming months.

The Indian rupee ended April 2025 on a stronger note, appreciating modestly against the U.S. dollar despite a month marked by volatility and geopolitical tensions. Beginning the month around ₹85.60 per dollar, the rupee closed at approximately ₹84.55—the strongest level seen so far this year. The rally was underpinned by several supportive global and domestic factors. A sharp decline in the U.S. Dollar Index (DXY) made emerging market currencies like the rupee more attractive, while falling global crude oil prices eased India’s import bill and improved trade dynamics. Inflows from foreign portfolio investors (FPIs), especially in equities, surged in the second half of the month, adding strength to the rupee. Exporter hedging strategies and easing domestic inflation further contributed to currency stability. On the domestic front, the Reserve Bank of India’s 25 basis point repo rate cut to 6%, its second consecutive cut, signalled a pro-growth stance. While rate cuts generally dampen foreign investor appeal, the rupee held firm thanks to strong inflows, lower oil prices, and improving macroeconomic sentiment. However, geopolitical tensions clouded the rupee’s trajectory. A militant attack in Kashmir on April 22 escalated India-Pakistan tensions, causing sharp rupee depreciation to ₹86.21 per dollar and pushing volatility to a two-year high. The RBI stepped in to curb speculative moves, but risk aversion lingered across markets. Challenges remained, including a widening trade and fiscal deficit, sluggish GDP growth, and structural economic constraints. Yet, the rupee’s ability to appreciate despite these headwinds highlights the influence of favourable global trends and robust market flows. To summarise, April 2025 showcased the rupee’s resilience amid global tailwinds and regional turbulence, closing stronger even as volatility tested investor confidence.

April 2025 presented a mixed yet insightful picture for

India’s mutual fund landscape, marked by impressive

equity fund performances, heavy outflows in debt

categories, and heightened volatility across several

segments. While investors benefited from selective

rallies, macroeconomic and geopolitical developments

introduced a degree of unpredictability.

Leading the performance charts were mid-cap equity

funds, which outpaced both large- and small-cap peers.

Despite strong returns, mid-cap and small-cap equity

funds were among the most volatile, swinging sharply in

response to foreign portfolio movements, elevated

valuations, and geopolitical concerns.

On the debt side, gilt funds emerged as surprise

outperformers, riding the tailwinds of falling bond yields.

With India’s 10-year government bond yield dropping to a

three-year low, top gilt funds offered over 5% returns for

the month. Corporate bond funds also registered decent

gains of around 3–4%, particularly those exposed to

high-quality issuers.

Credit risk funds and other rate-sensitive debt categories

also faced instability, largely influenced by changing

interest rate expectations and RBI’s April rate cut.

Meanwhile, sectoral and thematic funds, especially

those tied to export-led industries or tech, saw

inconsistent flows and returns amid a backdrop of trade

policy changes.

Multiple macro and policy factors contributed to April's

volatility. The month saw foreign investor outflows,

particularly in the first half, as global trade tensions and

protectionist policies from the U.S. spurred risk-off

sentiment. Sluggish GDP growth and muted earnings

from certain sectors added to investor caution.

Elevated market valuations prompted profit booking,

especially in mid- and small-cap segments, while

underperformance in specific sectors also weighed on

thematic funds. In terms of investor behaviour, equity

funds maintained healthy net inflows, with mid-cap,

small-cap, and flexi-cap categories drawing the most

interest. While large-cap funds saw flat flows,

sectoral/thematic funds experienced a dip in net inflows

as investors grew more cautious.

Conversely, debt funds witnessed significant outflows,

especially from gilt, floating rate, and constant maturity

schemes. These withdrawals were partly seasonal,

driven by advance tax payments, and partly due to

shifting interest rate differentials as U.S. bond yields

rose. Interest rate fluctuations and persistent inflationary

concerns further impacted debt fund valuations. Rising

geopolitical tensions—including the India-Pakistan

border flare-up—led to a flight to safety, spurring erratic

fund flows and market corrections.

Hybrid funds had a mixed month. Multi-asset and

balanced advantage funds saw steady inflows, while

conservative hybrid schemes—heavy on debt

allocations—suffered outflows. Meanwhile, passive

funds, particularly index ETFs, continued to gain traction

among retail investors, signalling a growing preference

for low-cost, market-linked strategies.

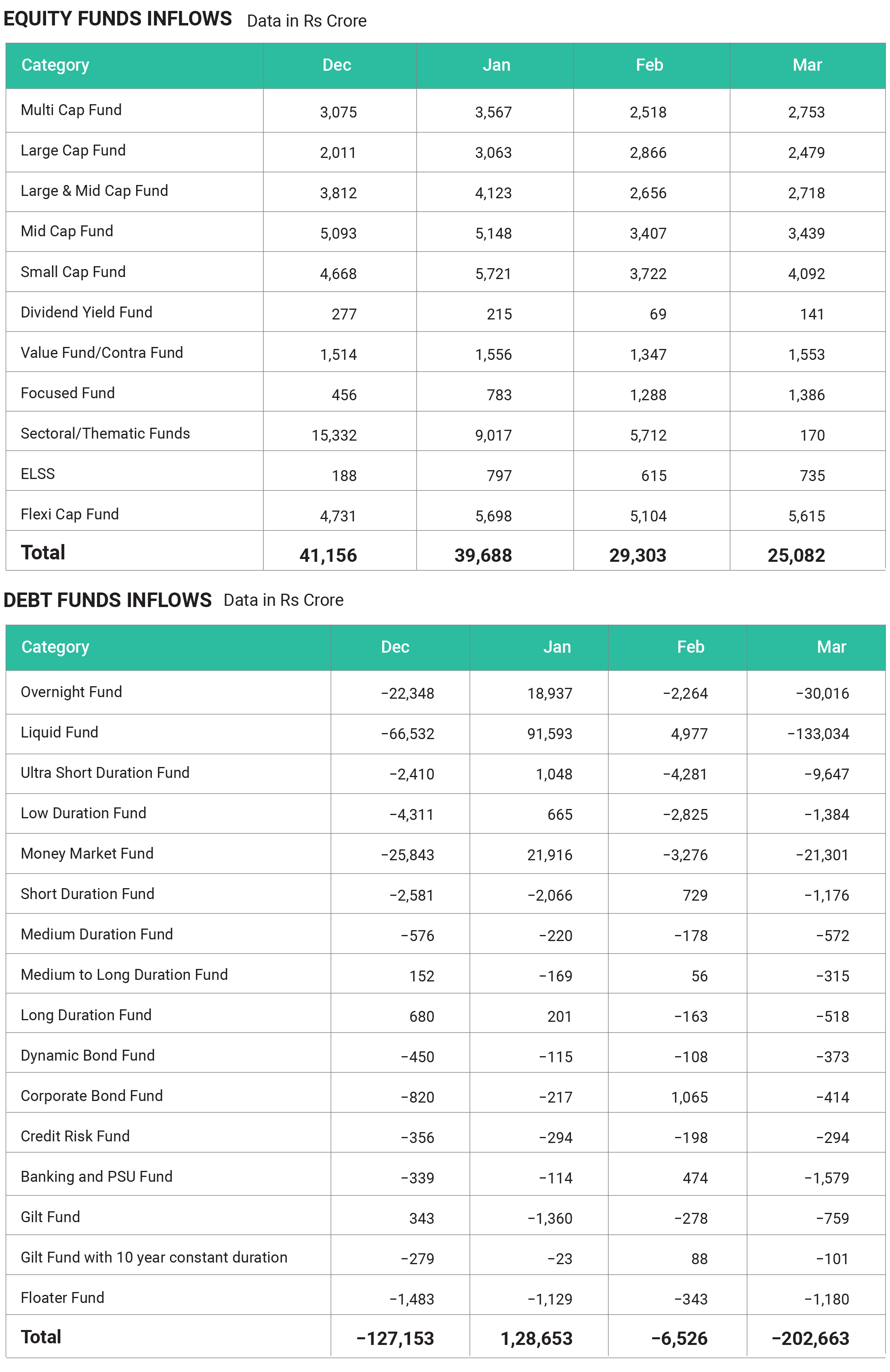

KEY TAKEAWAYS FROM AMFI INDIA DATA – MARCH 2025

Record Industry AUM: Mutual fund industry assets under management (AUM) reached ₹65.74 lakh crore, up 1.87%

month-on-month and 23% year-on-year, marking a more than sixfold increase over the past decade.

Equity Fund Trends: Equity mutual fund inflows dropped 14% to an 11-month low of ₹25,082 crore, reflecting investor caution

amid market volatility and global uncertainty, though equity AUM rose to ₹29.5 lakh crore due to market gains and SIPs.

Debt Fund Outflows: Debt-oriented schemes saw significant outflows (over ₹1.6 lakh crore), mainly from liquid funds, as

corporates withdrew for quarter-end advance tax payments.

Hybrid and Passive Funds: Hybrid fund AUM grew, led by strong inflows into multi-asset allocation funds. Passive funds hit

a record ₹11.47 lakh crore AUM, with net inflows for the 53rd consecutive month.

SIP Growth: SIP collections were robust at ₹25,926 crore, up 34.5% year-on-year, though they declined for the fourth straight

month, reflecting cautious sentiment.

Investor Base: Total mutual fund folios reached 23.45 crore, with retail investors (equity, hybrid, solution-oriented schemes)

accounting for about 18.58 crore folios

To conclude, April 2025 showcased a dynamic mutual fund environment, where mid-cap and gilt funds stood out as top performers amidst a backdrop of volatility, foreign capital shifts, and shifting investor strategies. The month reaffirmed the importance of diversification, timing, and risk management in navigating India’s evolving investment landscape

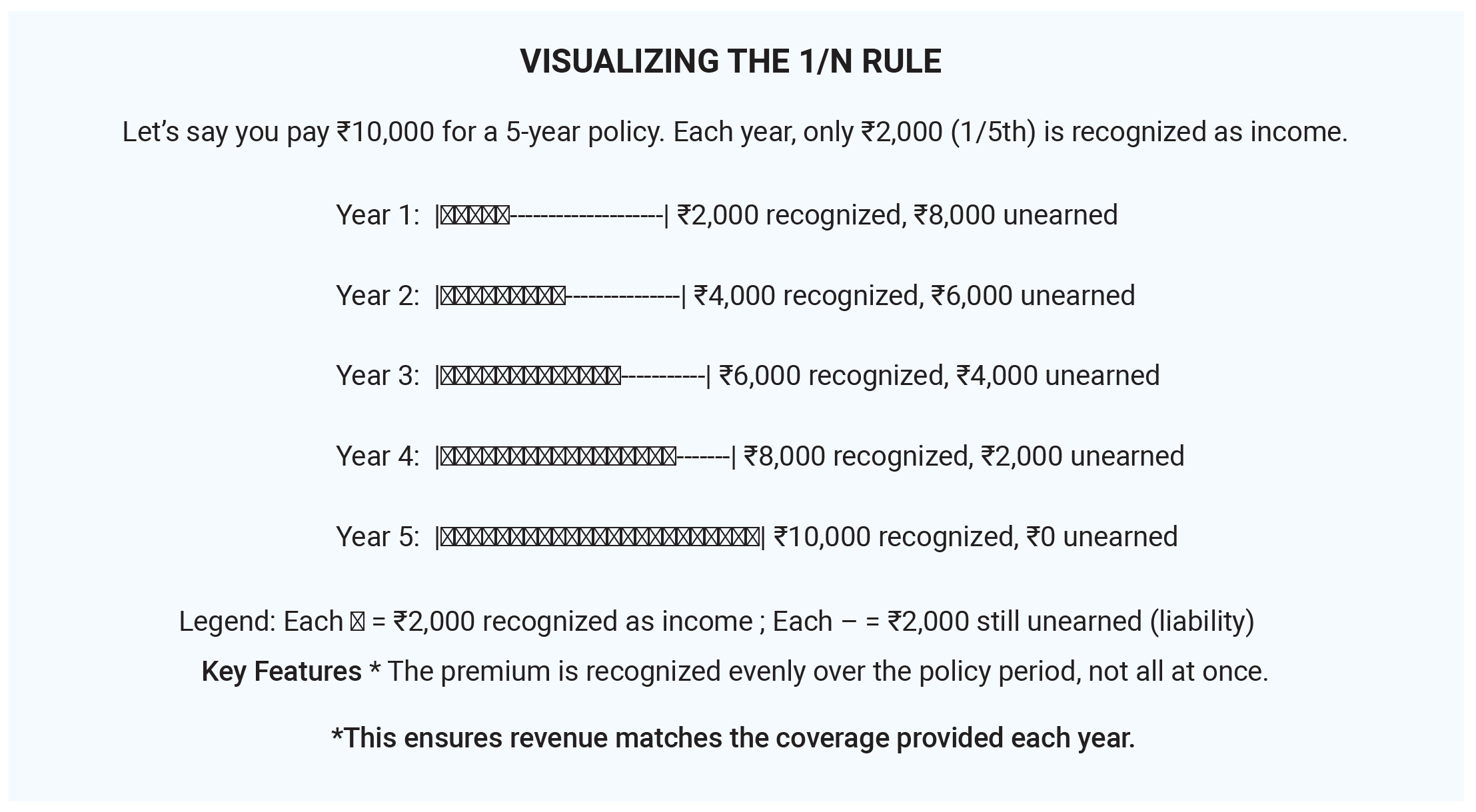

April 2025 was a defining month for India’s insurance industry—marked by a stark slowdown in growth, profitability concerns, and persistent consumer awareness challenges. Yet, the sector also showed signs of evolution, with bold regulatory reforms and foreign investment plans pointing to a more dynamic future. The non-life insurance segment witnessed a sharp deceleration, with overall industry growth halving in FY25. A combination of regulatory adjustments—most notably the new "1/n rule" on commission payouts—along with tepid vehicle sales and subdued commercial demand contributed to this downturn. Public sector insurers managed to post modest growth of 5.5% year-on-year in March, while private players reported a decline in premium collections.

Health insurance, which had been a key growth driver in recent years, led the slump. The sector's overall non-life premium growth fell to just 6.2% in FY25, down from 12.8% in FY24. Industry experts attributed this pullback to the broader economic slowdown and rising premiums, which strained consumer affordability. The profitability outlook remained muted for both life and general insurers. Life insurers grappled with margin compression as consumers increasingly moved away from high-margin products such as traditional endowment plans. On the general insurance front, high claim ratios—particularly in health and motor segments—strained balance sheets. Analysts predict subdued Q4 FY25 earnings for both segments. A nationwide survey revealed that nearly half of Indian consumers are still unaware of term insurance, highlighting the persistent financial literacy gap. This is despite the term insurance segment growing 18% in FY24, indicating that awareness remains a critical bottleneck for deeper market penetration. April also saw the groundwork laid for significant structural reforms. The government’s proposal to allow 100% foreign direct investment (FDI) in the insurance sector stirred global interest, with expectations of increased capital inflows, innovation, and expanded market coverage. If implemented, this reform could mark a turning point in India's insurance journey. Meanwhile, reinsurance developments gained momentum. International reinsurer Peak Re secured a license to operate in GIFT City, underlining India’s aspirations to position itself as a reinsurance hub for the broader Asia-Pacific region. Travel insurance saw an uptick in demand, driven by a post-pandemic surge in international travel, particularly among Gen Z consumers. In parallel, insurers began exploring customised solutions tailored for high-risk and emerging industries, including nuclear energy and marine logistics, to better serve the evolving risk landscape. While April 2025 highlighted the Indian insurance industry’s near-term struggles—from slowing growth to profitability constraints—it also showcased its potential for transformation. With major regulatory shifts, rising investor interest, and evolving customer needs, the sector stands at the threshold of a new chapter—one defined by innovation, inclusion, and global integration.

Copyright © 2021 Fintso