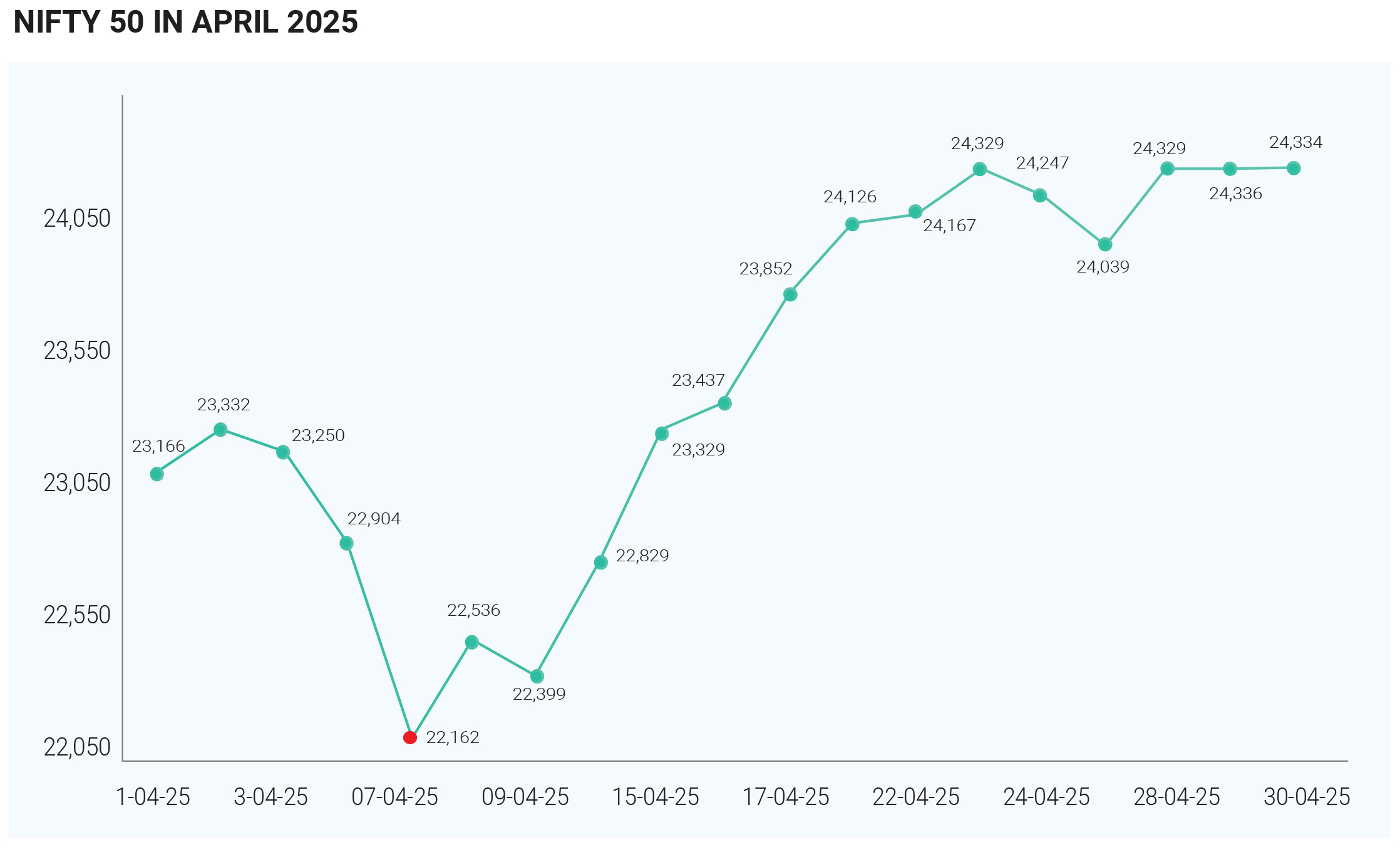

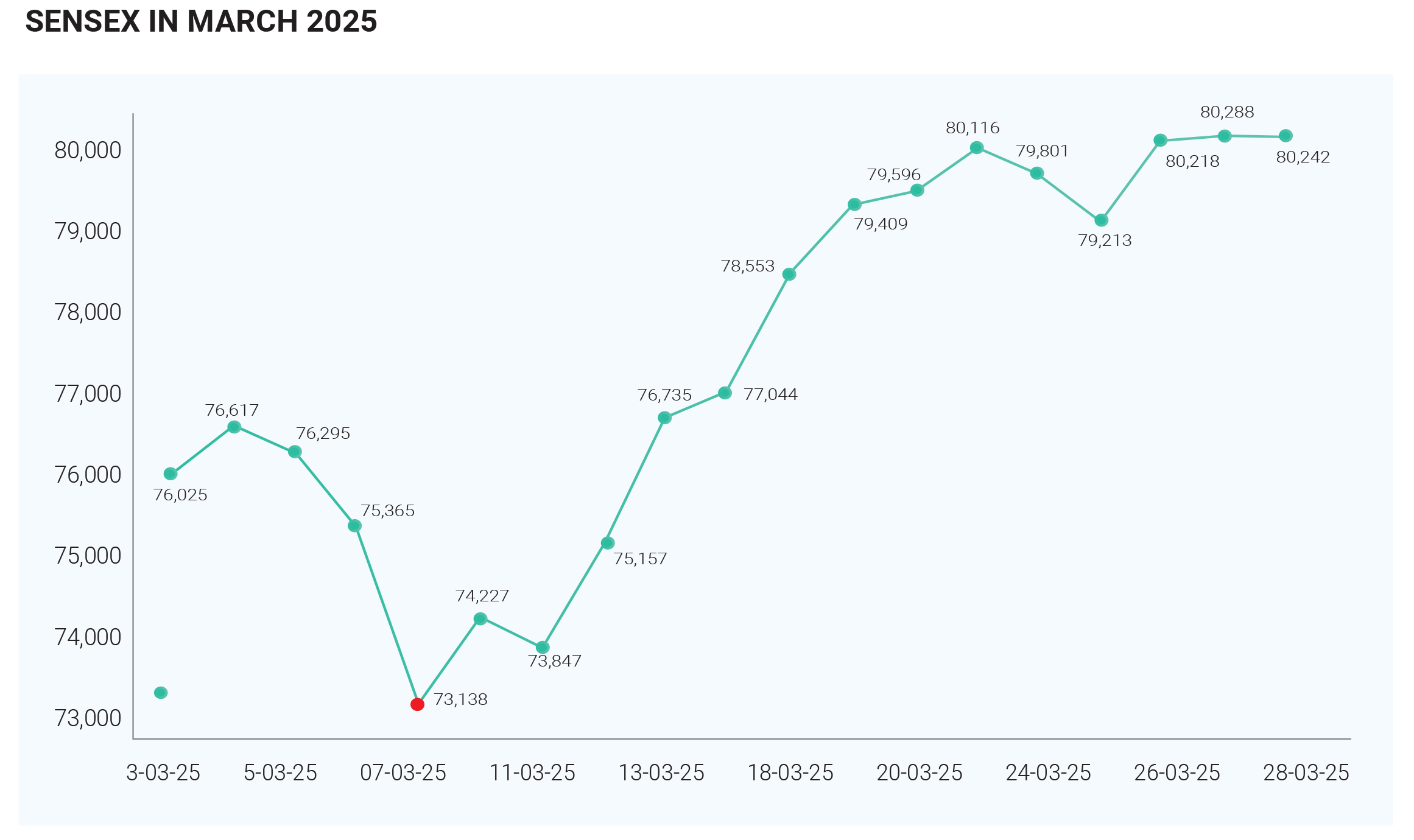

April 2025 proved to be a stellar month for Indian equity markets, with benchmark indices scaling record highs on the back of robust fundamentals and upbeat investor sentiment. The BSE Sensex surged from around 73,137 at the start of the month to close at 80,288 on April 29, marking one of its strongest monthly performances in recent times. Meanwhile, the Nifty 50 rallied from approximately 22,700 to end above 24,335, delivering a solid gain of over 6%.

The market rally was driven by a confluence of positive

factors. Strong corporate earnings across key sectors,

particularly banking, energy, and commodities,

reinforced investor confidence. Additionally, favourable

global cues—including steady economic data from major

economies and easing concerns around interest rate

hikes—helped sustain the bullish momentum.

A major catalyst behind April 2025’s remarkable market

rally was the sharp reversal in activity by Foreign

Institutional Investors (FIIs). After offloading over

₹40,000 crore in the first half of the month—amid global

tariff uncertainties and risk-off sentiment—FIIs staged a

dramatic comeback. In a striking turnaround, they poured

more than ₹38,000 crore into Indian equities during the

final 11 trading sessions, becoming aggressive buyers

and reigniting market momentum. This renewed inflow

was instrumental in propelling both the Sensex and Nifty

to record highs, with the indices registering over 10%

gains for the month. The FII shift was underpinned by a

weaker U.S. dollar, easing global trade tensions, and

growing optimism around India’s economic prospects,

including expectations of continued earnings growth and

macroeconomic stability

While FIIs stole the spotlight in April, Domestic

Institutional Investors (DIIs) played a crucial supporting

role—particularly during the first half of the month, when

they helped cushion the impact of FII outflows. However,

as foreign inflows surged in the latter half, DII

participation moderated, with some signs of profit

booking emerging. Overall, DII activity remained more

restrained compared to the aggressive stance taken by

FIIs, reflecting a cautious approach amid lofty valuations

and heightened geopolitical risks. Institutional activity

played a pivotal role in the rally. Both Foreign Institutional

Investors (FIIs) and Domestic Institutional Investors

(DIIs) remained net buyers throughout the month,

signalling broad-based conviction in India’s economic

growth prospects.

Robust Q4 FY25 earnings, particularly from heavyweight

corporates, played a central role in fuelling April’s market

rally. Leading the pack was Reliance Industries, whose

better-than-expected quarterly results triggered a sharp

surge in its stock price. As one of the index

heavyweights, Reliance’s rally had a significant positive

impact on broader market indices, reinforcing bullish

sentiment across the board. April’s sectoral performance

presented a diverse picture. Information Technology (IT)

and banking stocks emerged as the top performers,

buoyed by strong earnings and improved business

outlooks. The banking sector, in particular, benefited

from robust credit growth and healthy asset quality

trends. In contrast, pharma and metal stocks faced

headwinds, with some players seeing declines due to

margin pressures, regulatory concerns, and subdued

global demand. This divergence underscored the

market’s selective appetite, favouring sectors with clear

growth visibility and earnings strength.

In essence, April 2025 was a month of record-breaking

gains and strong investor optimism. With corporate

fundamentals remaining healthy and liquidity flows

intact, the Indian markets closed the month on a high

note, setting the stage for a potentially strong quarter

ahead