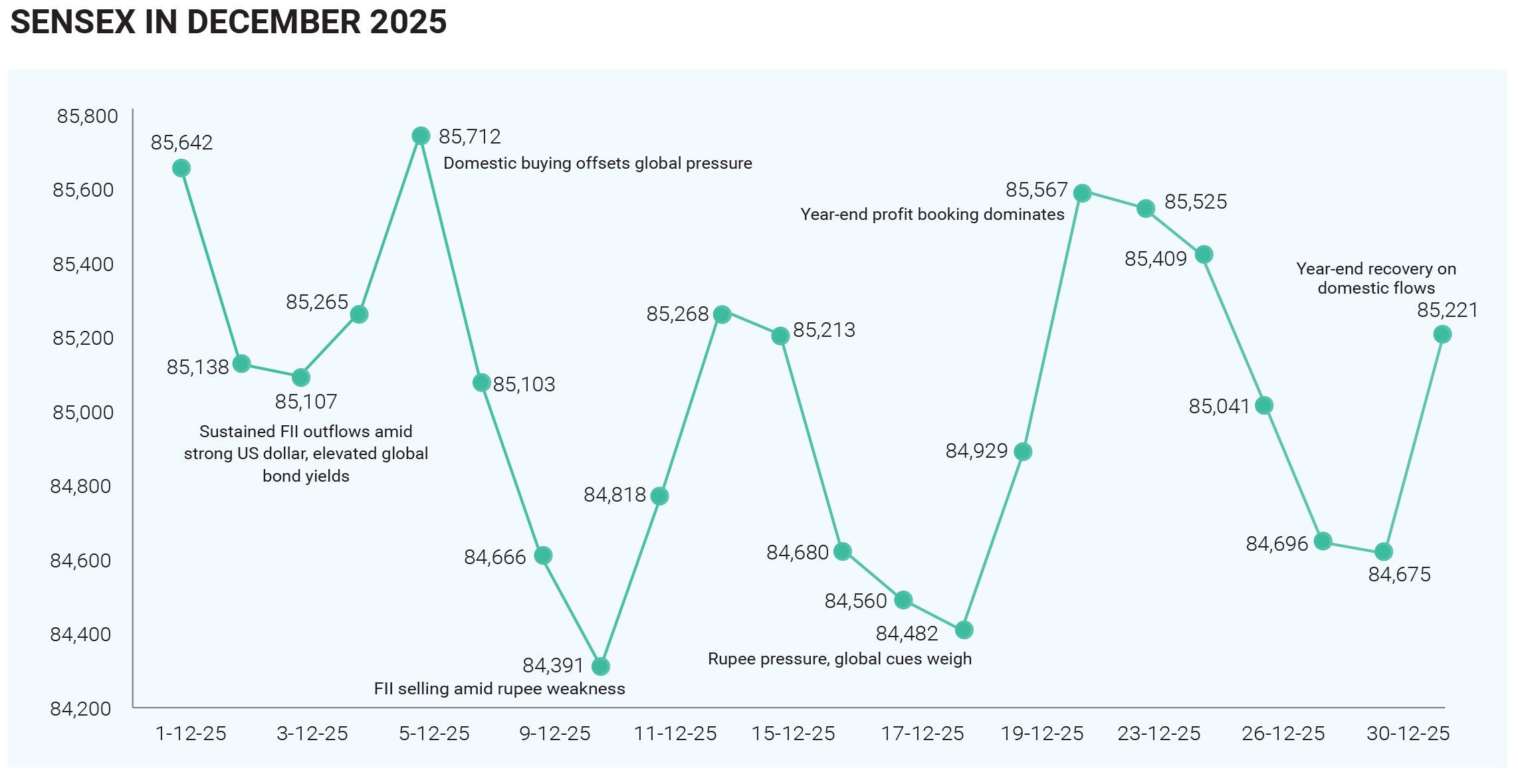

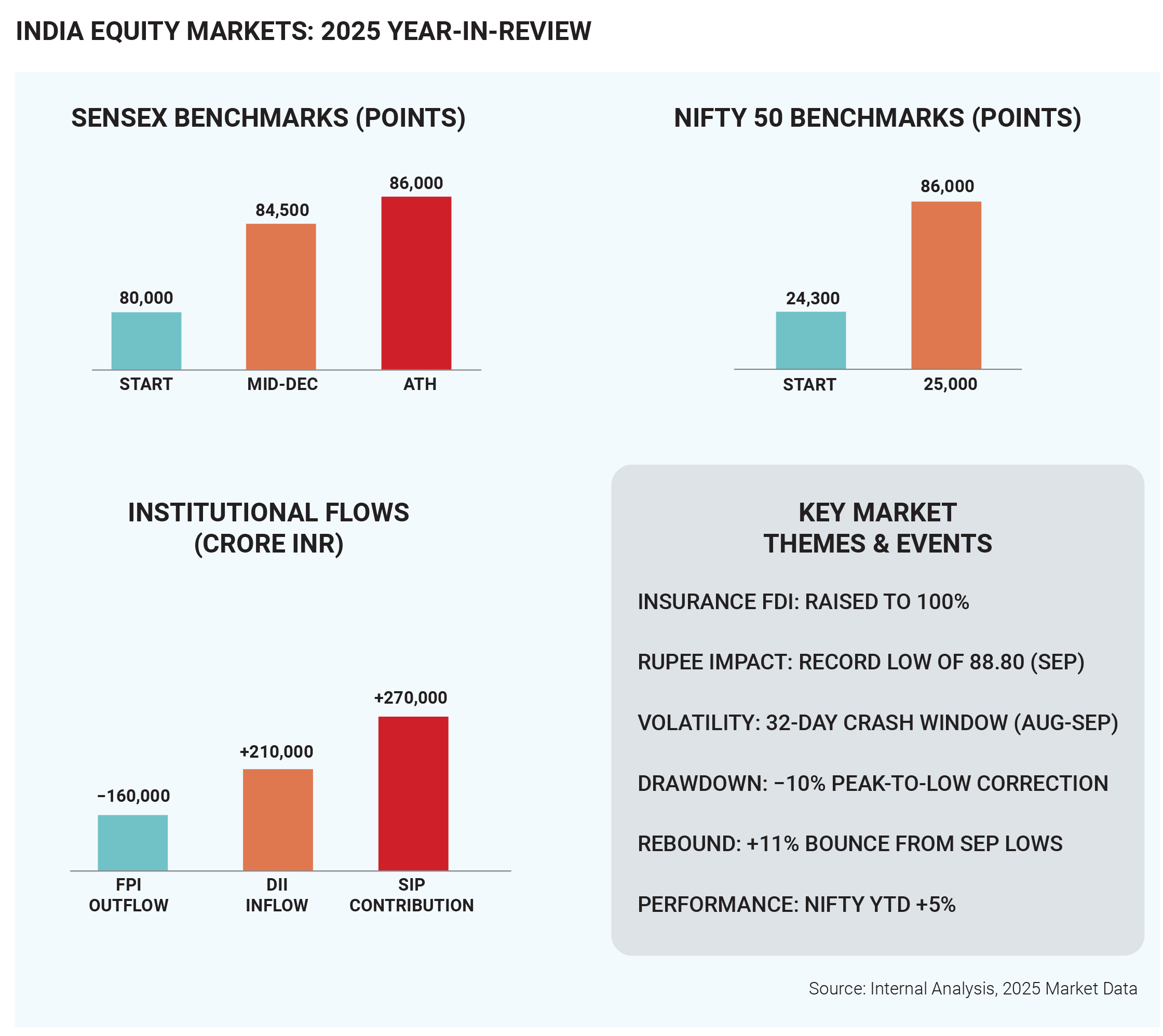

December 2025 proved to be a consolidation-heavy, range-bound month for Indian equities, marking a pause after the strong rally of the preceding quarter, with the Sensex and Nifty hovering close to record highs rather than extending gains. Both indices spent most of the month oscillating within narrow bands—Sensex broadly between 84,000 and 86,000 and Nifty around 25,700–26,300—reflecting a market that was digesting earlier gains amid mixed global and domestic cues. Early-month highs gave way to profit-booking, but every meaningful dip was met with buying support, allowing the indices to end the month near mid-December levels, with Sensex closing close to 85,220 after a sharp year-end bounce and Nifty finishing around the 25,939–26,130 zone. Weekly patterns through December reflected this balance, with modest declines such as a − 0.52% Sensex move in the week ending December 12 and −0.31% for Nifty in the week ending December 19, followed by late-month stabilization and mild gains, including a 0.74% rise for Nifty on December 31.

Volatility remained subdued compared with earlier phases of 2025; intraday swings were contained and corrections shallow, underscoring a “buy-on-declines” mindset, especially in large-cap stocks. Beneath the flat headline performance, however, there was clear internal rotation: investor preference shifted decisively toward quality large-caps, defensives and selective cyclicals, while mid- and small-caps, after an extended period of outperformance, largely consolidated. This rotation was shaped by a counterbalancing flow dynamic, with foreign portfolio investors (FPIs) remaining cautious and intermittently booking profits—net outflows for the month were estimated in the ₹19,600–25,000 crore range, driven by global risk fatigue, US policy uncertainty, emerging-market currency stress and sharp rupee depreciation toward 90.8 per dollar—while domestic institutional investors (DIIs) absorbed supply with strong inflows of nearly ₹40,000 crore, supported by steady SIP contributions, insurance and pension allocations.

The divergence between foreign selling and domestic buying prevented deeper drawdowns, kept market breadth tilted toward liquid frontline stocks, and reinforced the perception that domestic capital had become the marginal price-setter. Sectoral performance was notably differentiated compared with November’s broad-based rally: IT stocks benefited from sustained global demand for digital and AI-linked services and from rupee weakness, which supported earnings translation and margins; healthcare and pharma held up well as defensive plays with stable demand visibility, particularly in domestic-focused names and hospital chains; energy stocks outperformed on value buying and policy support, with integrated and downstream players aided by lower crude prices and expectations of healthy refining margins; financials delivered mixed but generally supportive performance, with PSU banks and select rate-sensitive lenders gaining on expectations of strong credit growth and an accommodative policy path, while some private banks faced intermittent pressure due to concerns around net interest margin compression and pockets of asset-quality stress; consumer sectors saw profit-taking in FMCG after earlier resilience despite improving volume trends and easing inflation, while discretionary stocks were stock-specific, with autos supported by demand and rate-cut hopes but retail names consolidating after sharp prior rerating; utilities remained among the weaker segments, as concerns around tariffs, demand visibility and operational pressures capped enthusiasm, limiting buying to balance-sheet-strong names; and metals and industrials moved in a choppy but mildly positive fashion toward month-end, helped by import-related policy measures, domestic capex expectations and year-end positioning despite uneven global demand indicators. The macro backdrop during the month remained largely supportive domestically: Q2 FY25 GDP growth around 8% exceeded expectations, inflation stayed benign, and the RBI delivered a dovish policy signal by cutting the repo rate by 25 basis points to 5.25%, announcing ₹1 trillion in open market operations and a USD 5 billion buy/sell swap to inject liquidity, which helped soften bond yields and underpin sentiment. However, these positives were tempered by external pressures, including a firm US dollar, weak emerging-market currencies, geopolitical uncertainty, US trade policy risks, China’s deflationary signals, and falling crude prices, all of which reinforced caution among foreign investors. The rupee’s nearly 2% depreciation over the month weighed on foreign returns but also highlighted India’s relative resilience: instead of triggering disorderly selling, equities absorbed the shock through sideways movement as domestic flows cushioned the impact. By year-end, market positioning clearly favoured quality, earnings visibility and balance-sheet strength over high-beta momentum, with index valuations cooling modestly from peak optimism but remaining supported by earnings delivery and liquidity. Overall, December 2025 closed with Indian equities in a deliberate, balanced stance: headline indices near record highs but without exuberance, foreign investors cautious but not capitulating, domestic institutions firmly in support, and the market entering 2026 consolidated, selective and grounded in fundamentals rather than momentum.

Indian debt markets in December 2025 navigated a

complex mix of supportive domestic policy actions and

constraining external and supply-side pressures,

resulting in a month of modest yield softening rather than

a sustained rally. Government bond yields eased

meaningfully through the middle of the month as the

Reserve Bank of India stepped up liquidity support, but

those gains were partly retraced toward month-end amid

heavy borrowing supply, currency weakness and global

rate headwinds. The benchmark 10-year government

security yield began December near 6.85%, declined

steadily as RBI interventions took effect, touched a low of

around 6.54% on December 24, and then stabilized in the

6.60–6.61% range by the end of the month.

Despite the late-month uptick, yields finished December

lower than they began, translating into positive returns

for duration-sensitive bond funds, although the extent of

gains remained capped. The RBI played a central role in

shaping market dynamics during the month, delivering a

25 basis point repo rate cut to 5.25% and complementing

it with large-scale liquidity measures, including open

market operations (OMOs) totalling roughly ₹2 trillion in

December alone and cumulative purchases exceeding ₹3

trillion for FY26, the highest on record. These bond

purchases, focused largely on the 6–7 year segment

such as the widely traded 6.33% 2035 bond, significantly

eased systemic liquidity conditions and compressed

term premiums, offering relief to a market that had been

grappling with cash shortages stemming from currency

in circulation outflows and RBI forex interventions.

Additional support came from USD 5 billion buy/sell

swaps, which injected durable rupee liquidity of ₹2–3

trillion and helped anchor overnight rates closer to the

repo rate. At the shorter end of the curve, one-year

government bond yields remained relatively stable in the

5.84–5.90% range, while overnight index swap (OIS)

rates between 5.46% and 5.76% early in the month

reflected intermittent liquidity tightness that gradually

eased as RBI measures filtered through the system. Even

with these actions, however, liquidity conditions were not

unambiguously comfortable: surplus liquidity declined to

around ₹3.3 trillion at times, and RBI infusions had to

counter an estimated ₹1.5–2 trillion drain from strong

credit demand and ongoing forex operations.

On the fiscal and supply side, persistent pressures

limited the scope for a deeper rally in yields. The

government’s borrowing program remained heavy, with

record state development loan (SDL) issuances in the

December quarter and a particularly large supply pipeline for

Q4, which weighed on demand-supply dynamics even as

OMOs absorbed some of the pressure. Concerns around

fiscal slippage also lingered, driven by a combination of tax

cuts, moderation in GST collections, and a high central

government debt burden—estimated at over 60% of total

market borrowings—which kept investors cautious about

aggressively extending duration. Banks’ holdings of

government securities fell to around 35.3% year-on-year,

indicating some balance-sheet constraints, while pension

funds showed signs of reallocating toward equities amid

strong stock market performance, reducing a traditionally

stable source of long-term demand.

Currency movements further complicated the picture, as the

rupee depreciated sharply by nearly 2% during December,

slipping to around 90.8 per US dollar amid heightened global

risk aversion, US tariff announcements of up to 50% on

certain trade fronts, and a firm dollar environment. This

depreciation raised concerns about imported inflation and

triggered bouts of foreign portfolio investor outflows from

the debt market, contributing to intermittent yield hardening

despite domestic easing. Inflation data at home remained

benign, supported by falling food prices, favourable base

effects and a decline of about 4.4% in global crude oil prices,

but global inflation persistence and the risk of currency

pass-through prevented markets from pricing in an

aggressive or front-loaded easing cycle.

Global factors continued to exert influence throughout the

month, with US Treasury yields holding above 4%, limiting

the relative attractiveness of Indian debt, while ongoing

tightening bias in parts of Europe, China’s deflationary

signals, and broader geopolitical uncertainties added to

volatility. Strong domestic macro data also played a

nuanced role: Q2 GDP growth of about 8.2% year-on-year led

to upward revisions of FY26 growth expectations toward

7.2%, reinforcing confidence in the economy but

simultaneously tempering expectations of sharp rate cuts

and anchoring longer-term yields.

As a result, while the RBI’s dovish stance and liquidity

operations successfully stabilized the bond market and

delivered moderate gains, especially in the belly of the curve,

external headwinds, fiscal supply pressures and currency

risks ensured that December 2025 remained a month of

measured easing rather than a decisive bond rally,

leaving the market balanced between supportive policy

and persistent structural constraints heading into 2026.

The Indian rupee weakened sharply against the US dollar

in December 2025, extending a year-long depreciation

trend and emerging as Asia’s worst-performing major

currency, though without signs of a balance-of-payments

crisis. The month began with the rupee trading around

₹89.6–89.7 per dollar but quickly slipped under

persistent pressure, breaching ₹90 in the first week,

touching record lows near ₹90.49 by December 11, and

briefly crossing ₹91 in mid-December before stabilising

toward the end of the month in the ₹90.8–90.9 range.

Overall, the rupee declined by about 2% during December

alone and more than 5% on a year-to-date basis,

significantly underperforming several Asian peers

despite a broadly stable global dollar index. This sharp

move reflected a convergence of domestic imbalances

and external shocks rather than a single trigger.

A major driver was sustained foreign portfolio investor

outflows, with FPIs selling over $1.6 billion of Indian

equities and debt during December and cumulative

equity outflows exceeding ₹1.48 lakh crore for the year,

as investors rotated toward safer dollar assets amid

global uncertainty, elevated US yields and concerns over

Indian asset valuations. These flows translated directly

into higher dollar demand as funds were repatriated,

intensifying pressure on both spot and forward currency

markets. Trade-related concerns compounded the

problem, as stalled US–India trade negotiations and

aggressive tariff hikes by the US—reportedly up to 50% on

key Indian exports such as textiles, pharmaceuticals and

electronics—eroded confidence in India’s external

earnings outlook and threatened export competitiveness.

These fears came on top of a widening trade deficit, with

weak global demand dragging exports lower while

imports surged due to higher purchases of gold, crude oil

and capital goods, forcing corporates and refiners to

front-load dollar buying. Currency market dynamics were

further amplified by heavy importer hedging and stress in

the offshore non-deliverable forward (NDF) market,

which pushed up forward premia and magnified each

bout of risk aversion.

Against this backdrop, the Reserve Bank of India adopted

a consciously measured approach, intervening selectively to

smooth volatility rather than defending any specific level.

While the RBI reportedly sold dollars intermittently—drawing

down reserves but keeping them at comfortable levels—it

allowed the rupee to act as a “shock absorber,” consistent

with its growth-supportive stance following a 25-basis-point

rate cut and the IMF’s classification of India’s regime as a

managed, crawl-like arrangement. This policy tolerance of

gradual depreciation helped prevent panic but also meant

that external pressures were reflected more fully in the

exchange rate.

Market reactions to the weaker rupee were contained rather

than disorderly: bond yields firmed slightly as currency risk

and current-account concerns lifted term premia, equities

faced intermittent foreign selling even as domestic investors

provided support, and the real economy confronted

near-term headwinds from imported inflation and costlier

foreign borrowing. At the same time, some analysts noted

that a weaker rupee could partially offset tariff damage by

improving export price competitiveness over time. By late

December, the breach of the psychologically important ₹90

level was widely interpreted not as a crisis signal but as a

policy-tolerated reset driven by trade shocks, capital

outflows and global risk aversion, leaving the rupee

stabilised but vulnerable heading into 2026 until clarity

emerges on tariffs, portfolio flows and global monetary

conditions

Crude oil prices weakened further in December 2025,

extending a year of pronounced declines as oversupply

concerns and soft global demand continued to dominate

market sentiment. West Texas Intermediate (WTI) crude

opened the month near USD 59.5 per barrel and drifted

steadily lower, falling into the high-USD 50s by

mid-December and ending the month in the USD

56.5–57.9 range, before slipping to around USD 57.3 in

early January 2026. On a monthly basis, WTI lost roughly

2–3%, capping a full-year decline of more than 20% from

highs above USD 80 seen earlier in 2025. Brent crude

followed a similar trajectory, easing from early-December

averages near USD 61–62 per barrel to around USD 60.7

by end-month, down just over 3% in December and

marking its fifth consecutive monthly fall. Although

intra-month volatility remained elevated, with sharp

swings driven by inventory data and geopolitical

headlines, the broader trend was decisively downward asmarkets increasingly priced in a sizeable supply surplus

for 2026.

The primary driver of December’s weakness was

persistent oversupply. OPEC+ producers, including

Russia, continued to pump at elevated levels despite

nominal quotas, while non-OPEC supply—particularly

from the US—remained resilient. Even when US crude

inventories showed occasional draws, such as a roughly

4.8 million barrel decline reported mid-month, product

inventories told a different story: gasoline and diesel

stocks continued to build, signalling weak refining

margins and subdued end-user demand. This reinforced

the view that supply was outpacing consumption, limiting

the market’s ability to sustain any meaningful rebound.

On the demand side, global consumption growth

disappointed. Manufacturing activity in major

economies, including China and parts of Asia, remained

sluggish, freight volumes softened, and industrial energy

usage stayed muted, outweighing seasonal or festive

demand. Forward-looking forecasts increasingly pointed

to a structural glut in 2026, as non-OPEC supply growth

was expected to exceed incremental demand even under

optimistic growth assumptions.

Geopolitical risks, which had supported prices earlier in

the year, proved insufficient to offset these

fundamentals. While ongoing Russia–Ukraine tensions,

sporadic attacks on energy infrastructure, and

uncertainty around sanctions on producers like

Venezuela injected brief risk premiums into prices, these

moves were short-lived. Markets increasingly judged that

geopolitical developments were unlikely to result in

sustained, large-scale supply disruptions, especially with

diplomatic channels open and spare capacity available

elsewhere. At the same time, macroeconomic conditions

added another layer of caution. A firm US dollar, with the

dollar index holding above 108, made oil more expensive

for non-US consumers, while lingering hawkishness from

the US Federal Reserve and concerns about a global

growth slowdown capped investor appetite for

commodities

For India, the December decline in crude prices was

broadly constructive. Brent crude around USD 60–61 per

barrel helped contain the oil import bill, supported the

current account, and eased inflationary pressures

despite higher import volumes. Lower energy costs also

reduced fiscal stress linked to fuel subsidies and input

costs for downstream industries. However, the

underlying reason for lower prices—weak global

demand—also carried negative implications, particularly

for India’s export outlook and global trade momentum.

Overall, December 2025 reinforced the view that oil

markets were transitioning into a lower-price regime, with

prices likely to remain range-bound in the USD 55–75 per

barrel zone into 2026 unless disrupted by a major supply

shock or an unexpectedly strong rebound in global

growth.

Gold and silver prices in India remained elevated through

most of December 2025, supported by a mix of global

safe-haven demand, currency effects and central bank

buying, before correcting sharply in the final days of the

month as profit-taking and year-end rebalancing set in.

Domestic 24K gold traded comfortably above the

₹14,000 per gram mark for much of the last week of

December, touching highs near ₹14,242 per gram on

December 27–29, but momentum faded quickly

thereafter. Prices fell to around ₹13,620 on December 30

and settled near ₹13,588 by December 31, marking a

steep decline of about 4.5% in the final stretch of the

month. Correspondingly, 22K gold ended December near

₹12,455 per gram and 18K around ₹10,191. Silver

followed a similar pattern, rising earlier in the month on

safe-haven inflows before softening toward the end as

risk appetite improved in equities and speculative

positions were unwound

The late-month correction was primarily driven by

aggressive profit-booking after a strong rally. Gold had

posted substantial gains earlier in the year, leaving prices

technically overbought, with momentum indicators such

as the relative strength index moving above 70. This

prompted traders and investors to lock in profits,

especially as the calendar year drew to a close. In India,

physical demand also tapered after the Diwali and

wedding-season peak, reducing support from jewellery

buying and encouraging dealers and investors to offload

holdings as part of tax planning and portfolio

rebalancing. Similar dynamics were visible globally,

where COMEX data showed speculators trimming long

positions after year-to-date gains of more than 25%,

reinforcing the downward pressure into month-end.

Despite the correction, gold’s broader tone in December

remained resilient, underpinned by geopolitical and

macroeconomic uncertainties. Early in the month,

heightened tensions in the Middle East, continued risks

around the Russia–Ukraine conflict, and intermittent

friction involving Venezuela and US sanctions injected a

risk premium into bullion prices, briefly pushing global

spot gold above USD 4,400 per ounce. These

developments supported safe-haven flows into

gold-backed ETFs and sustained central bank interest.

Global spot prices, while volatile, still ended December up

around 3% on a monthly basis, easing from late-month

highs to about USD 4,330 per ounce by early January

2026.

Currency movements played a critical role in shaping

domestic prices. The sharp depreciation of the Indian

rupee toward ₹90.8 per US dollar amplified local gold

prices through most of December, effectively adding an

import premium even when global prices softened. This

currency effect helped insulate Indian gold prices from

sharper declines earlier in the month. However, strength

in the US dollar, with the dollar index holding above 108,

capped international gains and eventually contributed to

the late-month pullback in ounce-denominated prices.

Falling crude oil prices helped ease import costs but

were insufficient to offset the combined impact of

profit-taking and stronger dollar dynamics.

Central bank buying remained a structural support.

Ongoing purchases by the RBI and other major central

banks, including China, reinforced gold’s role as a

long-term store of value amid de-dollarization trends and

geopolitical uncertainty, even as short-term momentum

faded. Overall, December 2025 for gold and silver was

characterized by a classic pattern of early resilience

followed by a sharp technical correction, leaving bullion

prices lower at the margin but still elevated in a broader

historical and strategic context heading into 2026.

In December 2025, India’s mutual fund industry navigated

a mixed but resilient environment, shaped by equity

market volatility, structural shifts in investor behaviour

and a few high-profile industry developments. A key

highlight was the ICICI Prudential AMC IPO, which

opened between December 12 and 16 and raised about

₹10,602 crore, drawing strong investor interest and

underscoring confidence in the long-term growth of the

asset management business. The listing brought

renewed visibility to the sector at a time when industry

assets under management (AUM) were hovering around

₹80–82 lakh crore, supported more by mark-to-market

gains than by aggressive net inflows. Despite intermittent

FII outflows and market consolidation, retail participation

remained stable, with SIP inflows staying robust at over

₹29,000 crore for the month, pushing annual SIP

collections beyond ₹3 trillion for the first time and

reinforcing the stickiness of domestic flows

At the same time, fund houses adjusted portfolios

cautiously. Cash holdings, which had been pared by

nearly ₹7,000 crore earlier during market rallies, remained

elevated on a year-to-date basis at around ₹2.01 lakh

crore, reflecting a preference for liquidity and selective

deployment. New fund offer (NFO) collections continued

to disappoint, with year-to-date mobilisation falling to

about ₹63,600 crore by November, weighed down by

tighter SEBI regulations, fewer thematic launches and

subdued investor appetite amid volatile equity

conditions. This led to a slowdown in new investor

additions, which stood at roughly 5.8 million, and shifted

fund-house focus away from NFOs toward established

schemes.

Flow trends across segments highlighted this

recalibration. Equity mutual funds saw moderated net

inflows, largely SIP-driven, with flexi-cap and

mid-/small-cap categories attracting interest even as

lump-sum investments stayed cautious. Debt schemes

experienced net outflows of around ₹8,400 crore,

reflecting liquidity needs and cautious corporate

treasuries. In contrast, hybrid funds recorded healthy

inflows near ₹12,000 crore, driven by demand for

arbitrage and multi-asset strategies, while passive funds

continued to gain share, with AUM exceeding ₹14 lakh

crore, supported by steady inflows into gold and silver

ETFs. Overall, December reflected a mutual fund industry

that remained structurally strong, supported by

disciplined retail participation, even as near-term flows

adjusted to market volatility and regulatory changes.

Copyright © 2021 Fintso