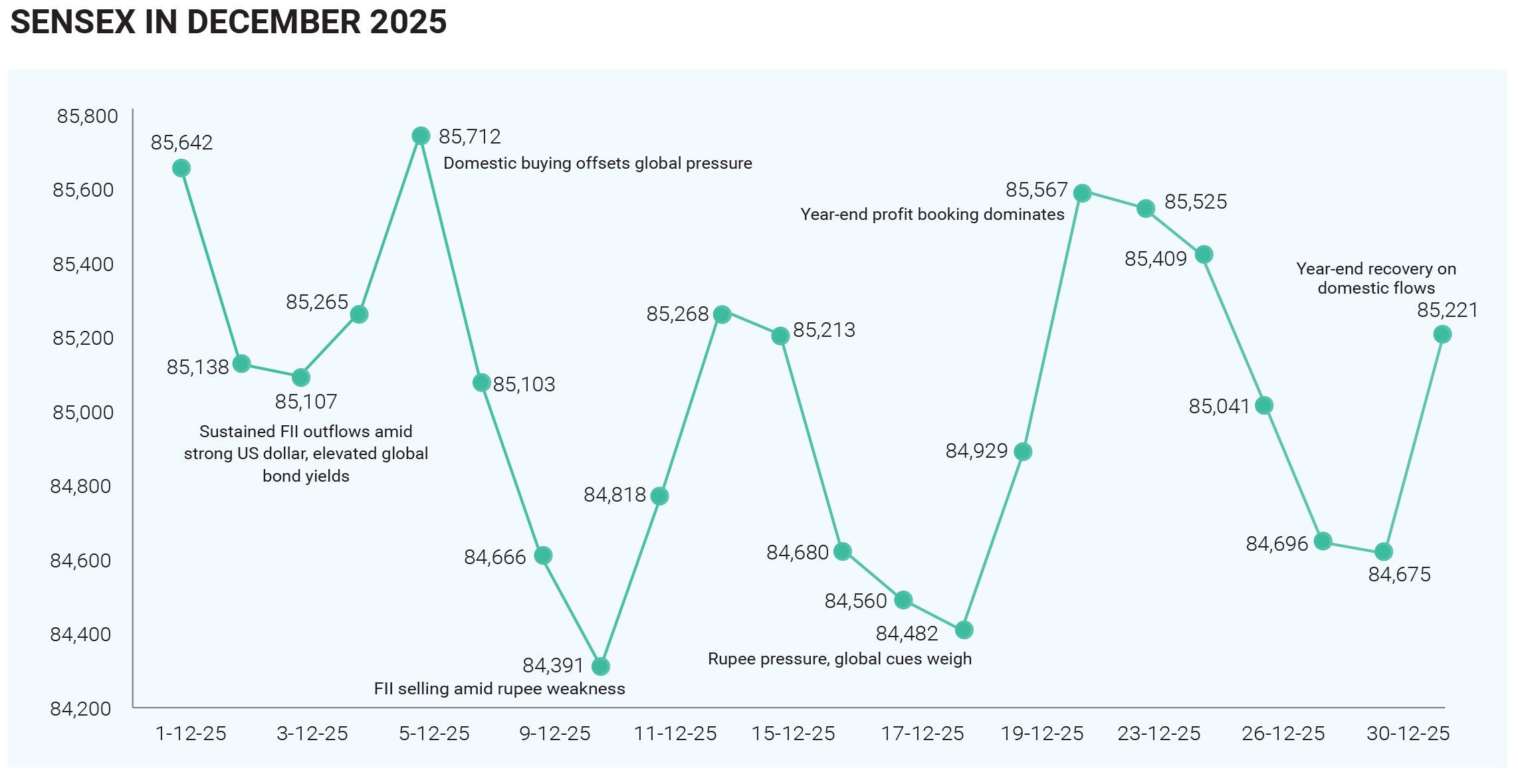

December 2025 proved to be a consolidation-heavy, range-bound month for Indian equities, marking a pause after the strong rally of the preceding quarter, with the Sensex and Nifty hovering close to record highs rather than extending gains. Both indices spent most of the month oscillating within narrow bands—Sensex broadly between 84,000 and 86,000 and Nifty around 25,700–26,300—reflecting a market that was digesting earlier gains amid mixed global and domestic cues. Early-month highs gave way to profit-booking, but every meaningful dip was met with buying support, allowing the indices to end the month near mid-December levels, with Sensex closing close to 85,220 after a sharp year-end bounce and Nifty finishing around the 25,939–26,130 zone. Weekly patterns through December reflected this balance, with modest declines such as a − 0.52% Sensex move in the week ending December 12 and −0.31% for Nifty in the week ending December 19, followed by late-month stabilization and mild gains, including a 0.74% rise for Nifty on December 31.

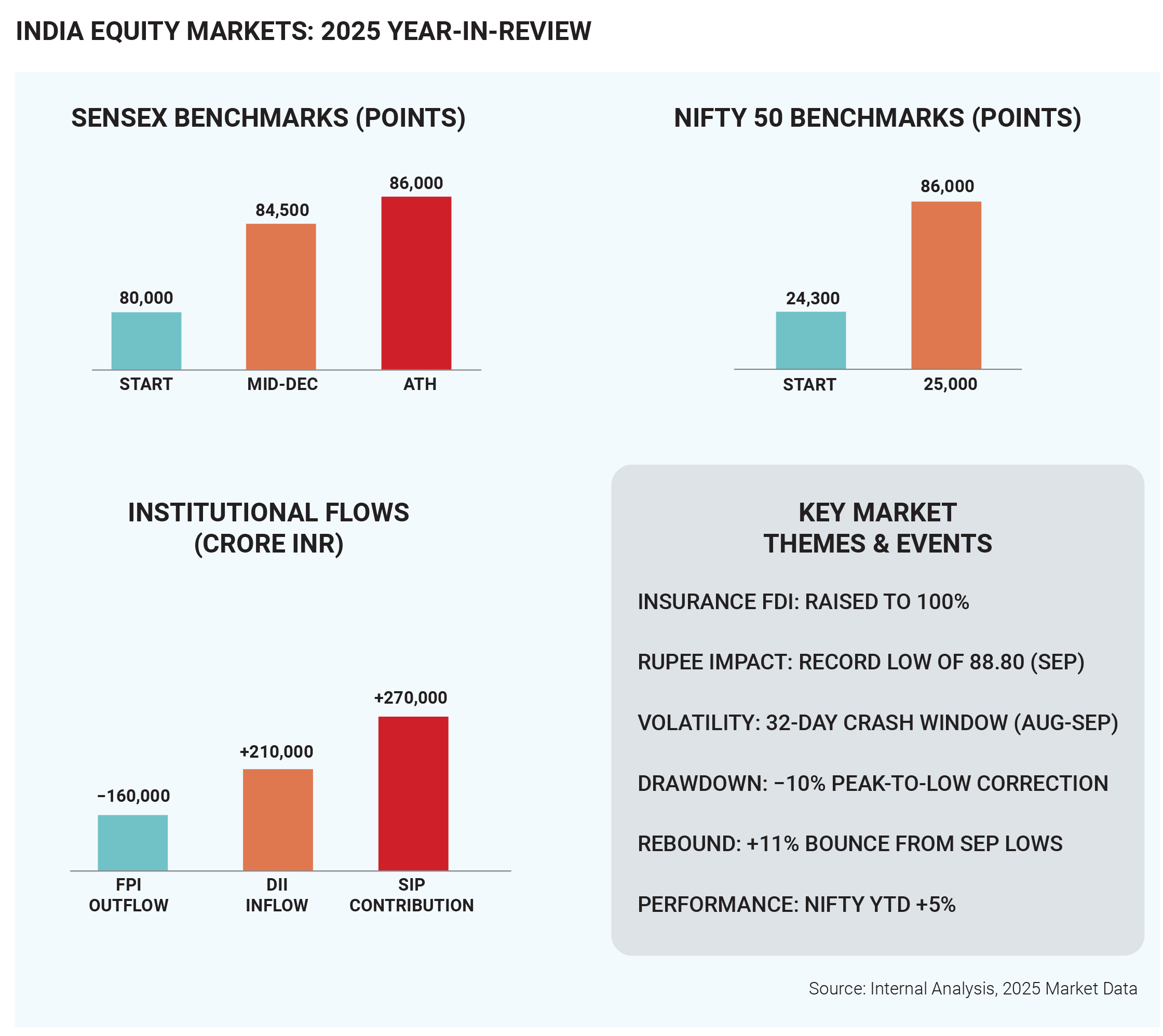

Volatility remained subdued compared with earlier phases of 2025; intraday swings were contained and corrections shallow, underscoring a “buy-on-declines” mindset, especially in large-cap stocks. Beneath the flat headline performance, however, there was clear internal rotation: investor preference shifted decisively toward quality large-caps, defensives and selective cyclicals, while mid- and small-caps, after an extended period of outperformance, largely consolidated. This rotation was shaped by a counterbalancing flow dynamic, with foreign portfolio investors (FPIs) remaining cautious and intermittently booking profits—net outflows for the month were estimated in the ₹19,600–25,000 crore range, driven by global risk fatigue, US policy uncertainty, emerging-market currency stress and sharp rupee depreciation toward 90.8 per dollar—while domestic institutional investors (DIIs) absorbed supply with strong inflows of nearly ₹40,000 crore, supported by steady SIP contributions, insurance and pension allocations.

The divergence between foreign selling and domestic buying prevented deeper drawdowns, kept market breadth tilted toward liquid frontline stocks, and reinforced the perception that domestic capital had become the marginal price-setter. Sectoral performance was notably differentiated compared with November’s broad-based rally: IT stocks benefited from sustained global demand for digital and AI-linked services and from rupee weakness, which supported earnings translation and margins; healthcare and pharma held up well as defensive plays with stable demand visibility, particularly in domestic-focused names and hospital chains; energy stocks outperformed on value buying and policy support, with integrated and downstream players aided by lower crude prices and expectations of healthy refining margins; financials delivered mixed but generally supportive performance, with PSU banks and select rate-sensitive lenders gaining on expectations of strong credit growth and an accommodative policy path, while some private banks faced intermittent pressure due to concerns around net interest margin compression and pockets of asset-quality stress; consumer sectors saw profit-taking in FMCG after earlier resilience despite improving volume trends and easing inflation, while discretionary stocks were stock-specific, with autos supported by demand and rate-cut hopes but retail names consolidating after sharp prior rerating; utilities remained among the weaker segments, as concerns around tariffs, demand visibility and operational pressures capped enthusiasm, limiting buying to balance-sheet-strong names; and metals and industrials moved in a choppy but mildly positive fashion toward month-end, helped by import-related policy measures, domestic capex expectations and year-end positioning despite uneven global demand indicators. The macro backdrop during the month remained largely supportive domestically: Q2 FY25 GDP growth around 8% exceeded expectations, inflation stayed benign, and the RBI delivered a dovish policy signal by cutting the repo rate by 25 basis points to 5.25%, announcing ₹1 trillion in open market operations and a USD 5 billion buy/sell swap to inject liquidity, which helped soften bond yields and underpin sentiment. However, these positives were tempered by external pressures, including a firm US dollar, weak emerging-market currencies, geopolitical uncertainty, US trade policy risks, China’s deflationary signals, and falling crude prices, all of which reinforced caution among foreign investors. The rupee’s nearly 2% depreciation over the month weighed on foreign returns but also highlighted India’s relative resilience: instead of triggering disorderly selling, equities absorbed the shock through sideways movement as domestic flows cushioned the impact. By year-end, market positioning clearly favoured quality, earnings visibility and balance-sheet strength over high-beta momentum, with index valuations cooling modestly from peak optimism but remaining supported by earnings delivery and liquidity. Overall, December 2025 closed with Indian equities in a deliberate, balanced stance: headline indices near record highs but without exuberance, foreign investors cautious but not capitulating, domestic institutions firmly in support, and the market entering 2026 consolidated, selective and grounded in fundamentals rather than momentum.