The Indian stock market witnessed a robust resurgence in March 2025, putting an end to a prolonged five-month losing streak that had stretched from October 2024 through February 2025. With renewed investor enthusiasm and favourable economic indicators, both the BSE Sensex and the NSE Nifty closed the financial year 2024-25 (FY25) on a strong and optimistic note. Notably, mid-cap and small-cap stocks delivered particularly impressive returns, outperforming broader indices and attracting considerable attention from retail and institutional investors alike.

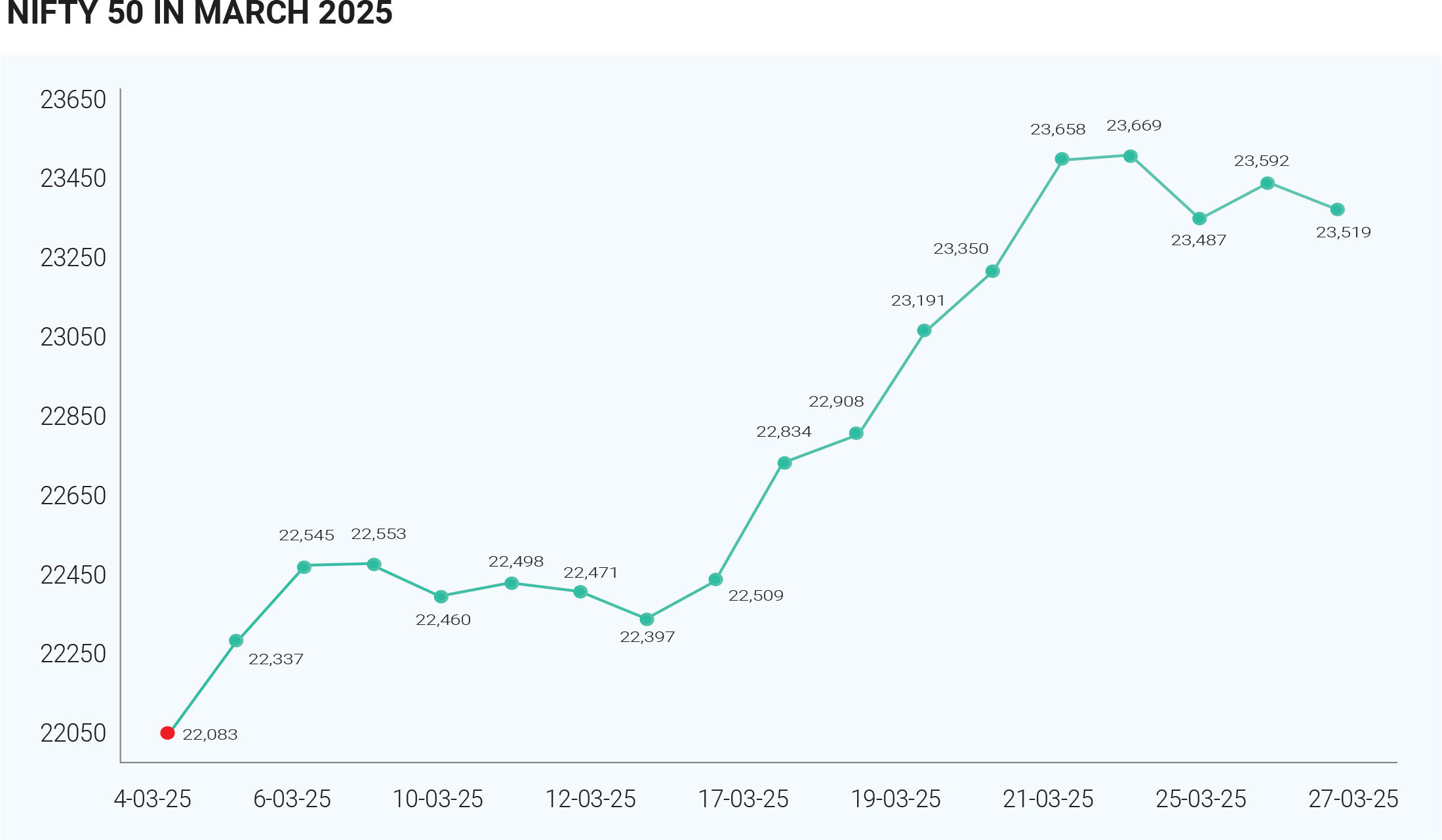

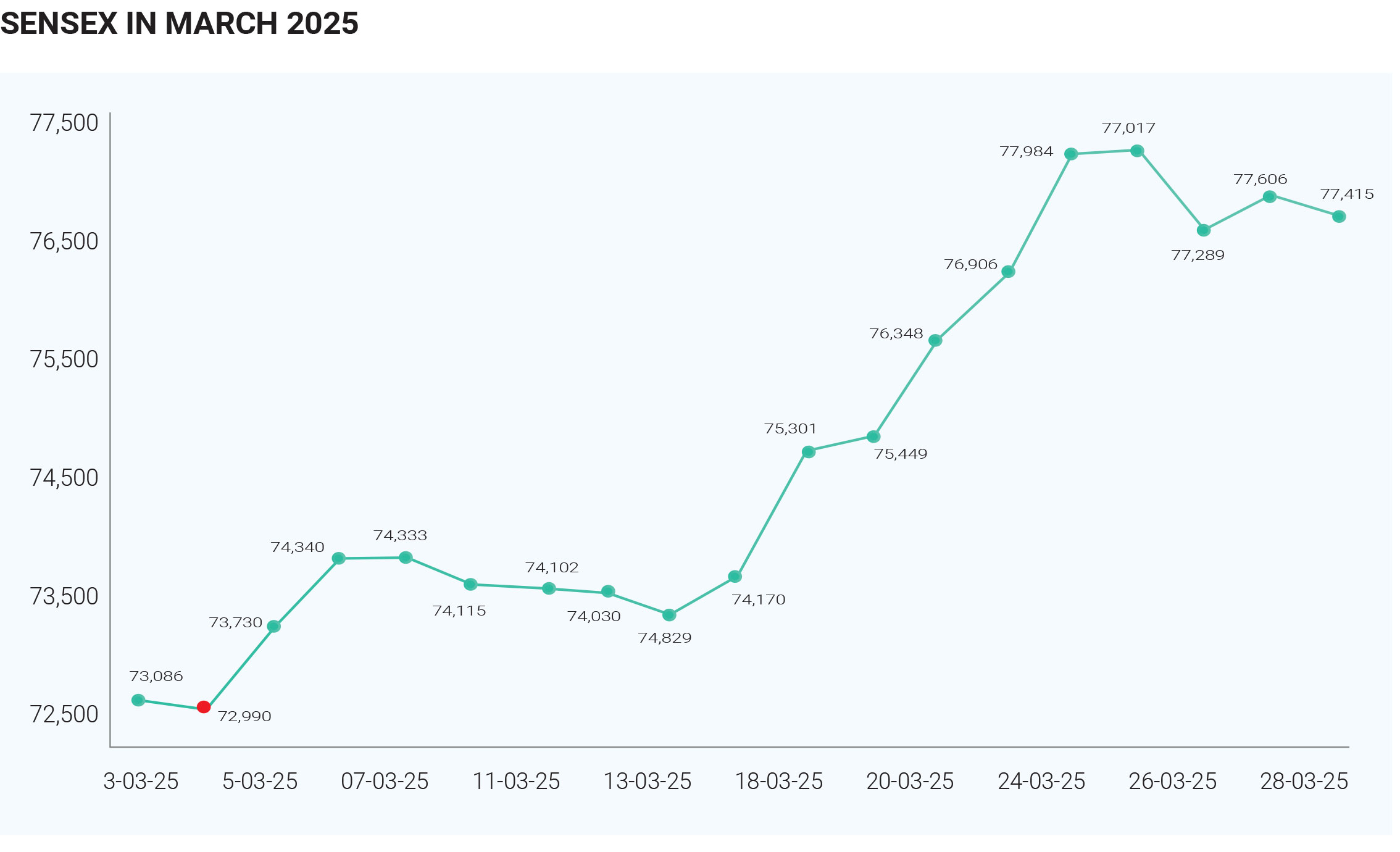

The BSE Sensex recorded a sharp gain of approximately 6.53% over the course of March, effectively reversing some of the losses accumulated earlier in the fiscal year. The index opened the month at 74,608.66 and closed at 76,882.58 on March 31, highlighting a significant upward trajectory. Similarly, the NSE Nifty 50 posted a monthly gain of around 6.3%, starting from 23,356 on March 1 and ending the month at 23,519.35. This marked one of the most positive months for Indian equities in recent times.

A combination of sectoral strength, macroeconomic improvements, and global cues contributed to this bullish trend. Sectors such as financial services and information technology (IT) played a leading role in driving the indices higher. The Indian economy provided a supportive backdrop, with inflation easing to 4.31% in January 2025—closer to the Reserve Bank of India’s (RBI) target. This decline in inflation raised investor hopes for potential interest rate cuts in the upcoming months, thereby fuelling market optimism. Market sentiment was further buoyed by expectations of a rebound in India's GDP, particularly in the fourth quarter of FY25. Investors and analysts anticipated improved economic growth figures, supported by strong industrial output in January 2025, which exceeded market expectations. Government spending remained elevated, and consumer income levels showed an upward trend, both of which contributed to the revival of domestic demand and market performance. Multiple sectors contributed meaningfully to the March 2025 rally, benefiting from the improving domestic macroeconomic landscape as well as favourable global developments. Among the top-performing sectors, energy stood out as the most profitable, registering gains of nearly 10% during the month. This strong performance was largely attributed to global supply-demand dynamics and rising crude oil prices, which helped energy companies post better-than-expected earnings. The financial sector also showed substantial strength, fuelled by improved fundamentals and renewed foreign institutional investor (FII) interest. Major banking stocks like ICICI Bank and Axis Bank were among the top performers, significantly contributing to the gains in the Nifty. These gains reflected growing investor confidence in the resilience of the Indian banking system The IT sector, initially under pressure due to global uncertainties and disruptions in the tech space, recovered gradually as the month progressed. Companies such as Tata Consultancy Services (TCS) and HCL Technologies demonstrated resilience and stability, helping bolster overall market sentiment. The automotive sector saw notable momentum, with companies like Mahindra & Mahindra and Tata Motors recording strong gains amid rising demand and positive sales figures. The metal sector also made a comeback, thanks in part to Chinese stimulus efforts and a weakening U.S. dollar. Stocks such as Hindalco Industries and Tata Steel showed significant strength during certain trading sessions. Healthcare remained a steady performer, supported by robust demand and resilient earnings from key players like Sun Pharma, which attracted renewed interest from both domestic and foreign investors. Large-cap stocks were central to the market’s strong performance in March. Companies like SRF Ltd, Bajaj Finance, and Kotak Mahindra Bank emerged as top gainers among the large-cap segment. Their gains were driven by strong earnings potential, positive economic tailwinds, and heightened investor confidence amid improving domestic indicators. These companies benefited from favourable sectoral dynamics, consistent performance, and their ability to attract institutional capital. Their resilience during the market downturn in previous months made them particularly attractive as the markets turned positive. One of the most significant developments in March was the turnaround in FII behaviour. After months of sustained selling pressure, FIIs became net buyers, signalling a major shift in market sentiment. This reversal acted as a major catalyst for the stock market rally. On March 21, FIIs recorded their largest net equity purchase of the year, infusing ₹7,470 crore into Indian equities in a single day. Over a three-day span, total FII purchases exceeded ₹13,500 crore. This sharp uptick in foreign inflows bolstered market confidence and played a crucial role in driving the Nifty 50 to rise over 6% in just one week—its best performance since February 2021. The Sensex also saw a massive jump, adding ₹22 lakh crore in investor wealth. While a large part of this inflow was attributed to passive investments triggered by FTSE index rebalancing, the broader change in FII sentiment nonetheless supported the rally. However, when adjusted for these mechanical flows, FIIs remained cautious, continuing to show some selling pressure—highlighting that the overall foreign investment appetite was still measured. The strong FII inflows also had a positive impact on the Indian rupee, which registered its best weekly gain in two years. The currency regained all its year-to-date losses, strengthening significantly on the back of renewed foreign interest. As we move into April 2025, a mix of global and domestic factors will likely determine the next phase for the Indian stock markets. Investor focus will be divided between international developments and key local economic indicators. Globally, attention will be centred on the United States, with the release of critical economic data such as GDP growth, employment numbers, and inflation figures. Any major surprises—especially negative ones—could influence global markets, including India. Furthermore, changes in U.S. trade policy, particularly any announcements related to tariffs, will be closely watched. A protectionist approach could dampen sentiment in emerging markets, whereas a more open stance might spark optimism. On the domestic front, inflation and interest rate trends will remain in the spotlight. The RBI’s upcoming policy stance will be critical—especially if inflation continues its downward trajectory, paving the way for potential rate cuts. Such monetary easing could inject liquidity into the system and support market expansion. India’s GDP data for the fourth quarter of FY25 is also expected to play a pivotal role. Strong growth figures would further reinforce the positive market outlook and attract both retail and institutional investors. Continued strength in industrial production, government spending, and consumer demand will be vital in maintaining the bullish momentum seen in March. In summary, while the impressive gains in March have set a strong tone for FY25, sustaining this momentum will depend on a careful interplay of global cues, domestic policy decisions, sector-specific performances, and investor sentiment

The Indian debt market during March 2025 experienced a favourable shift in sentiment, underpinned by improving liquidity conditions, falling bond yields, and a cautiously optimistic outlook. This positive tone was largely supported by the Reserve Bank of India’s (RBI) accommodative policy stance, as well as encouraging domestic economic indicators. Throughout the month, the market witnessed several key developments that were shaped by a combination of internal macroeconomic factors and global economic dynamics. One of the defining features of the month was the downward trajectory of the benchmark 10-year government bond yield. At the beginning of March, the yield stood at approximately 6.853%, but as the month progressed, it declined steadily, reaching around 6.6249% by month-end. This drop was driven by multiple factors, most notably a stronger-than-anticipated demand for state government debt, alongside the RBI’s continued dovish commentary and supportive monetary interventions. These factors together contributed to easing borrowing costs and bolstering investor confidence. The yield curve, however, remained inverted for most of the month, reflecting an unusual situation where short-term interest rates were higher than long-term rates. This inversion is typically interpreted as a signal of market expectations for future rate cuts. As expectations mounted for further monetary policy easing from the RBI, the curve began to exhibit signs of steepening in the latter part of the month. This shift benefited medium-duration debt instruments, which are sensitive to changes in the middle segment of the curve. To ensure financial stability and maintain smooth market functioning, the RBI continued to actively manage liquidity through a variety of policy tools. These included open market operations (OMOs), currency swaps, and variable rate repo (VRR) auctions. Each of these instruments served a specific role in addressing short-term liquidity mismatches and supporting market sentiment. A particularly significant development was the central bank’s conduct of multiple government bond purchase auctions. These purchases, including the third such auction held during March, injected additional liquidity into the system. As a result, bond prices gained support, contributing to the overall decline in yields across the curve. The RBI’s continued intervention reaffirmed its commitment to fostering accommodative financial conditions. On the inflation front, retail price data remained encouraging. Consumer price inflation for February 2025 was reported at 3.61%, comfortably within the RBI’s medium-term target range. This moderation in inflation gave the central bank additional room to consider rate cuts in the future without risking price instability. At the same time, economic growth indicators suggested moderate but steady momentum, which further buoyed market confidence. These favourable domestic trends encouraged expectations among investors for further easing by the RBI, making bonds—especially those with longer tenures—more attractive due to the potential for capital appreciation as rates decline. While domestic conditions provided a strong foundation, the Indian debt market also had to navigate external challenges. The most notable among these was the growing uncertainty stemming from global trade tensions. The United States imposed new tariffs on goods imported from Canada and Mexico, stoking fears of a wider trade conflict and triggering volatility across global markets. Against this backdrop, the International Monetary Fund (IMF) projected global economic growth at a tepid 3.3% for both 2025 and 2026—figures that remain below the long-term global average. These projections included a mix of upward and downward revisions across major economies, reflecting uneven momentum and fragile recovery paths. Although inflationary pressures appeared to be easing on a broad scale, services inflation persisted in several advanced economies, complicating efforts by central banks to normalize monetary policy. Amid this uncertainty, global central banks adopted divergent stances. The European Central Bank (ECB), for instance, was expected to begin cutting interest rates to stimulate its economy. In contrast, the U.S. Federal Reserve remained cautious, as the implications of ongoing trade disputes and inflation volatility continued to cloud its policy outlook. Another significant concern on the global front was the projected rise in sovereign borrowing. According to recent estimates, total global government borrowing was expected to hit a record high of $12.3 trillion in 2025. This spike was attributed to a combination of expansive fiscal measures and the elevated interest rate environment that persisted across major economies. The surge in public debt levels raised questions about fiscal sustainability and increased the potential for instability in sovereign bond markets, especially in countries with weaker fiscal positions. In currency markets, the U.S. dollar showed signs of weakness throughout March, largely due to rising concerns about a potential escalation in trade disputes and their broader implications for global economic stability. Simultaneously, crude oil prices declined, driven by weaker global demand forecasts. Lower oil prices also helped ease inflationary pressures in importing countries like India, indirectly supporting the bond market by reinforcing the case for monetary policy accommodation. Given the prevailing macroeconomic and market environment, investment experts recommended a strategic focus on medium-duration bond funds. These instruments were expected to benefit from the ongoing steepening of the yield curve and the likelihood of future rate cuts. Moreover, within the fixed income space, AAA-rated corporate bonds emerged as a compelling choice for yield-seeking investors. These securities offered more attractive returns compared to government bonds, while still maintaining high credit quality and relatively low risk. March 2025 was a month marked by cautious optimism and relative stability in the Indian debt market. A supportive domestic environment, proactive policy measures by the RBI, and favourable inflation dynamics helped offset the impact of global uncertainties. While external challenges—including rising geopolitical tensions and fiscal risks—continued to pose headwinds, the Indian bond market demonstrated resilience and remained well-positioned for further growth. Investors looking for opportunities in the fixed income space were advised to adopt a balanced approach, focusing on medium-duration strategies and high-quality corporate debt instruments in the coming months.

Crude oil prices in March 2025 exhibited a mixed trend, shaped by a combination of geopolitical developments, trade policies, and global economic indicators. The West Texas Intermediate (WTI) crude oil benchmark opened the month at approximately $70.18 per barrel. Despite experiencing fluctuations throughout the month, it ended slightly higher at $71.39 per barrel by March 31, marking a modest overall gain of around 1.72%. However, during the month, prices dipped as low as $65.75 on March 10, reflecting the ongoing volatility in the global energy markets. Multiple global factors influenced crude oil price movements. One of the primary drivers was geopolitical risk, particularly the imposition of tariffs by the United States on oil imports from select countries, including Venezuela. These trade restrictions disrupted traditional supply chains and raised concerns about global supply constraints, leading to short-term market uncertainty. Additionally, escalating trade tensions between major global economies contributed to a broader sense of economic unease, dampening investor sentiment and weakening oil demand forecasts. On the supply side, a significant development was the announcement by the Organization of the Petroleum Exporting Countries and its allies (OPEC+) regarding their future production strategy. OPEC+ confirmed plans to gradually increase oil output in small, controlled increments starting in April 2025, extending through September 2026. While the group’s cautious approach signalled a desire to support market stability, forecasts suggested that the increase in oil production—especially from non-OPEC sources—could eventually outpace the growth in global demand. If this surplus materializes, it could place downward pressure on prices in the coming quarters. Meanwhile, the global economic outlook also played a critical role in shaping oil market dynamics. Economic growth projections were revised downward for several major economies, which in turn led to lowered expectations for global oil consumption. Concerns about a potential recession intensified during the month, prompting fears of reduced industrial activity and energy usage. These factors weighed heavily on market sentiment and contributed to heightened price volatility. Despite these bearish influences, some supportive factors helped stabilize prices. A key bullish development was the reported decline in U.S. crude oil inventories. According to data released during the month, U.S. crude stockpiles dropped by approximately 4.6 million barrels. This drawdown signalled tighter domestic supply conditions and provided some upward momentum for prices, particularly during the latter part of the month. Looking ahead, crude oil prices are expected to remain volatile in April 2025. Ongoing geopolitical tensions, the evolving status of international trade agreements, and shifts in global economic conditions will likely continue to influence market direction. Additionally, further inventory data and updates on OPEC+ compliance with production targets will be closely monitored by investors and analysts. While short-term price gains are possible, underlying uncertainty surrounding demand growth and supply expansion could keep prices in a fragile balance in the near term.

In March 2025, the bullion market, particularly gold, witnessed a mixed yet largely positive performance influenced by global economic conditions, geopolitical tensions, and domestic factors. Gold prices in international markets peaked at $3,168.6 per ounce on March 20. In the Indian market, 24K gold rose to a monthly high of ₹9,066 per gram on the same date, marking a notable increase from the monthly low of ₹8,662 on March 1. Throughout the month, domestic gold prices exhibited an upward trend, though fluctuations occurred due to global price movements and changing local demand patterns. Silver also followed a positive trajectory in the domestic market, with noticeable gains, especially around March 24, reflecting renewed investor interest in precious metals amid uncertain economic conditions. Gold’s appeal as a safe-haven asset was strengthened by heightened geopolitical risks and trade tensions, particularly the U.S. tariffs on several countries. These developments raised concerns over global economic stability, leading investors to shift towards more secure assets like gold. Additionally, expectations of interest rate cuts by major central banks, especially the U.S. Federal Reserve, further supported gold prices by lowering the opportunity cost of holding non-yielding assets. A weakening U.S. dollar during the month also contributed to gold’s rally, as gold becomes more attractive to investors holding other currencies. Investment demand remained robust, with gold ETFs seeing significant inflows—$9.4 billion in February alone—signalling strong institutional interest. Central banks continued adding gold to their reserves, further reinforcing its long-term value. Moreover, inflationary concerns driven by tariffs and macroeconomic uncertainty added to gold’s attractiveness as an inflation hedge. These combined factors resulted in a strong performance for bullion in March, with investor sentiment expected to remain bullish in the near term.

In March 2025, the Indian Rupee (INR) exhibited notable volatility against the U.S. Dollar (USD), influenced by both domestic economic conditions and global financial trends. The month began with the USD/INR exchange rate at ₹87.4715 on March 1, briefly peaking at ₹87.4416 on March 2. However, the rupee strengthened steadily throughout the latter part of the month, reaching its lowest level—indicating appreciation—at ₹85.4358 on March 31. While the average exchange rate for the month was not specified, the movement suggests a strengthening of the rupee toward the end of March. The rupee’s trajectory was initially pressured by outflows from Foreign Institutional Investors (FIIs), reflecting global risk aversion and portfolio rebalancing. However, as market sentiment improved, renewed FII inflows supported a rebound in the currency. Exporters also contributed to the rupee’s appreciation by selling dollars, particularly during the final weeks of the month. Domestically, a widening trade deficit due to increased imports posed challenges for the rupee, exerting downward pressure during the first half of March. Nonetheless, several supportive factors helped the rupee recover. Favourable macroeconomic indicators, such as easing retail inflation, boosted investor confidence and strengthened the currency on select days. Additionally, falling global crude oil prices reduced India’s import bill, offering relief to the rupee and improving the overall balance of payments. The Reserve Bank of India (RBI) also played a key role in managing currency volatility through strategic market interventions and liquidity management tools. Overall, the rupee’s performance in March 2025 reflected a complex interplay of global economic developments, capital flows, trade dynamics, and proactive central bank measures. Going forward, INR is expected to remain sensitive to global interest rate decisions, commodity prices, and foreign investment trends.

In March 2025, the Indian mutual fund industry witnessed strong performance, primarily driven by a sharp rally in equity markets and sustained investor participation. Equity mutual funds delivered impressive returns, with the HDFC Defence Fund leading at 22% for the month. PSU-themed funds also posted solid gains of around 13–16%, while small-cap and mid-cap funds benefited from strong market momentum. The Sensex rose 5.76% and the Nifty 50 gained 6.30%, while the Nifty Mid-Cap and Nifty Small Cap surged 7.84% and 9.49% respectively, fuelling returns in related fund categories. Retail investor interest remained high, especially in the small and mid-cap segments. While March data for SIP inflows and AUM is pending, February’s AUM stood at ₹64.53 trillion, indicating a five-fold growth over the past decade. Overall, the mutual fund industry in March thrived on favourable market conditions and robust retail investor sentiment. The mutual fund industry in India is currently undergoing significant regulatory changes introduced by the Securities and Exchange Board of India (SEBI). One of the key updates pertains to the deployment timeline for funds collected through New Fund Offers (NFOs). SEBI has now made it mandatory that the money raised via NFOs must be invested or deployed within a strict period of 30 business days from the date on which the units are allotted to investors. This rule is intended to ensure timely and efficient utilization of investor funds. In situations where an Asset Management Company (AMC) is unable to meet this 30-day deployment requirement, there is an option to apply for an extension. However, this extension is allowed only once and is limited to an additional 30 business days. Furthermore, such an extension must be approved by the AMC’s Investment Committee. If, despite the extension, the funds are not deployed within the total window of 60 business days, SEBI has laid down specific consequences. The AMC in question will be required to immediately halt all fresh inflows into the concerned scheme. Additionally, investors must be allowed to exit the scheme without incurring any penalties or exit loads, and the AMC must communicate this situation clearly to all investors. In another major development, SEBI has introduced a new category of investment vehicles called Specialised Investment Funds (SIFs). These funds are positioned between the traditional Mutual Funds and Portfolio Management Services (PMS), offering a unique middle ground for investors. SIFs come with more flexible and tailored investment strategies compared to regular mutual funds, but they also have stricter entry requirements. To invest in a SIF, an individual must commit a minimum investment of ₹10 lakh. Moreover, only those AMCs that have consistently maintained Assets Under Management (AUM) of ₹10,000 crore or more for the last three financial years are eligible to launch and manage SIFs. This criterion ensures that only well-established and experienced fund houses can offer such specialized investment products. Another notable initiative introduced by SEBI is the integration of mutual fund holdings with DigiLocker, a government-backed digital storage platform. This move is aimed at streamlining the record-keeping and accessibility of financial assets for investors. With this integration, investors will be able to store and easily access their statements related to Demat accounts and mutual fund holdings in digital format. This step is expected to significantly reduce the number of unclaimed assets in the financial system and also simplify the process for nominees to access the investments of a deceased investor. It enhances transparency, reduces paperwork, and adds a layer of convenience and security for investors and their beneficiaries.

The tax exemption slab will be raised from ₹7 lakh to ₹12 lakh under the new regime, benefiting middle-class taxpayers

|

Income Tax Slabs |

Income Tax Rates |

|

Upto Rs.4 lakh |

NIL |

|

Rs. 4 lakh - Rs.8 lakh |

5% |

|

Rs.8 lakh - Rs.12 lakh |

10% |

|

Rs.12 lakh - Rs.16 lakh |

15% |

|

Rs.16 lakh - Rs.20 lakh |

20% |

|

Rs.20 lakh - Rs.24 lakh |

25% |

|

Above Rs.24 lakh |

30% |

The rebate u/s 87A for taxpayers filing tax returns under the New Tax Regime was increased to Rs. 60,000 from the previous limit of Rs. 25,000. Now the taxpayer can enjoy a tax-free income of up to Rs. 12 Lakhs. This means taxpayers earning income up to Rs. 12 Lakhs will have no tax liability under the new tax regime. The rebate for taxpayers opting for the Old Tax Regime remains the same i.e., Rs. 12,500. The provisions of TDS have significant changes that will be applicable from April 2025. It was proposed to enhance threshold limits for various TDS sections for both individuals and businesses. The threshold for TDS on interest received by senior citizens was increased to Rs 1 lakh from the previous limit of Rs. 50,000. Similarly, the thresholds for rent and commissions were also increased.

|

Section |

Before 1st April 2025 |

From 1st April 2025 |

|

193 - Interest on securities |

NIL |

10,000 |

|

194A - Interest other than Interest on securities |

(i) 50,000/- for senior citizens |

(i) 1,00,000/- for senior citizen |

|

|

(ii) 40,000/- in case of others when the payer is the bank, cooperative society and post office |

(ii) 50,000/- in case of others when the payer is a bank, cooperative society and post office |

|

|

(iii) 5,000/- in other cases |

(iii) 10,000/- in other cases |

|

194K - Income in respect of units of a mutual fund |

5,000 |

10,000 |

|

194K - Income in respect of units of a mutual fund |

5,000 |

10,000 |

|

194B - Winnings from lottery, crossword puzzle Etc.& 194BB - Winnings from horse race |

Aggregate of amounts exceeding 10,000/- during the financial year |

10,000/- in respect of a single transaction |

|

Section |

Before 1st April 2025 |

From 1st April 2025 |

|

194D - Insurance commission |

15,000 |

20,000 |

|

194G - Income by way of commission, prize etc. on lottery tickets |

15,000 |

20,000 |

|

194H - Commission or brokerage |

15,000 |

20,000 |

|

194-I – Rent |

2,40,000 (in a financial year) |

50,000 per month |

|

194J - Fee for professional or technical services |

30,000 |

50,000 |

|

194LA - Income by way of enhanced compensation |

2,50,000 |

5,00,000 |

|

194T - Remuneration, Interest and Commission paid to partners |

NIL |

20,000 |

The threshold for withholding TCS for overseas remittance through LRS will be increased to Rs. 10 lakhs from the

previous limit of Rs. 7 lakhs. Further, there will be no TCS on remittance of educational loans taken from a financial

institution. Previously, a TCS of 0.5% was applicable if the remittance exceeded Rs. 7 lakhs. Section 206C(1H) which

required sellers to collect TCS on the sale of goods when the sale value exceeded Rs. 50 lakhs has been removed and

won't be applicable from 1st April, 2025 onwards.

The deadline for filing an Updated Tax Return was extended from 12 months to 48 months (4 years) from the end of the

relevant assessment year. This extension was to encourage the taxpayers to disclose any previously undisclosed

incomes and pay relevant taxes on the same. The additional tax liability based on the timeline of filing an updated return.

Any investor who has not linked their PAN with Aadhaar will have their dividend payouts suspended. Additionally, in such

cases, TDS rates will increase, and no credit will be reflected in Form 26AS.

The 6% equalisation levy, commonly known as the "Google Tax," has been

abolished. This levy, primarily imposed on online advertising services, was removed through an amendment to the

Finance Bill 2025 on March 24. The move is expected to ease the tax burden on Indian consumers of digital advertising

GOODS SERVICES TAX

From April 1, 2025, several significant changes are being implemented in the Goods and Services Tax (GST) framework

in India. Here are the key changes which would streamline GST compliance, enhance transparency, and simplify tax

processes for businesses in India:

- Multi-Factor Authentication (MFA) is mandatory for all GST portal users to enhance security and prevent unauthorized access.

- Biometric Authentication: GST registration now requires biometric authentication within 15 days to generate the Application Reference Number (ARN).

- Sequential Invoicing: Businesses must start a new, sequential invoice series from April 1, 2025, to maintain accurate records and ensure compliance.

- Compulsory ISD: Businesses with multiple GSTINs under the same PAN must obtain ISD registration to distribute Input Tax Credit (ITC) across units, enhancing transparency and compliance.

- IMS Integration: Recipients of credit notes must accept or reject them through the Integrated Management System (IMS) to prevent ITC mismatches.

- Used Car Sales: The GST rate on used car sales increases from 12% to 18% across all categories, eliminating previous differentiations based on engine size or type.

- Tax Relief: Businesses that have cleared all tax dues up to March 31, 2025, can apply for a GST waiver under specific schemes within three months.

- Hotel Industry: The "Declared Tariff" concept is abolished. GST will now be levied on the actual transaction value, with hotels charging above ₹7,500 per day classified as "specified premises" and attracting 18% GST on restaurant services with full ITC benefits.

PENSION SCHEME

From April 1, 2025, the Unified Pension Scheme (UPS) under the National Pension System (NPS) will be implemented for central government employees. The scheme guarantees a pension based on service tenure. Employees with at least 25 years of service will receive 50% of their last 12 months’ average basic salary as a pension. Employees contribute 10% of their basic salary plus dearness allowance (DA). The government's contribution increases from 14% to 18.5%, with an additional 8.5% going into a separate pooled fund. A minimum monthly pension of ₹10,000 is guaranteed for those with at least 10 years of service. The scheme includes gratuity and a lump sum retirement payout. In case of an employee's demise, the family receives 60% of the pension amount.

UNIFIED PAYMENT INTERFACE

NPCI has mandated that banks and payment service providers (PSPs) update their databases before March 31 to remove recycled or churned mobile numbers. Banks and UPI apps must use the Mobile Number Revocation List (MNRL) available on the Digital Intelligence Platform (DIP) to prevent errors and fraud risks. Users must ensure their bank account is linked to an active mobile number before April 1 to avoid disruptions.

UAN ACTIVATION FOR EPF-LINKED INSURANCE:

Activate your UAN by March 15, 2025, to access

EPF-linked insurance benefits

TAX-SAVING INVESTMENTS:

Invest in tax-saving instruments under Sections

80C, 80D, etc., such as PPF, NPS, ELSS, and

tax-saving FDs before March 31, 2025, to claim

deductions in the current financial year

ADVANCE TAX PAYMENTS:

Ensure the fourth instalment of advance tax is paid

by March 15, 2025, to avoid penalties under

Sections 234B and 234C.

UPDATED INCOME TAX RETURN (ITR-U):

File or update your income tax return by March 31,

2025, if you missed reporting income or made

errors in previous filings.

MINIMUM INVESTMENTS IN

GOVERNMENT SCHEMES:

Ensure minimum annual investments in schemes

like PPF and Sukanya Samriddhi Yojana to keep

accounts active and avoid penalties.

SPECIAL FIXED DEPOSITS:

Invest in special fixed deposit schemes before

March 31, 2025, to secure higher interest rates.

BANKING SERVICES ON MARCH 31:

Utilize banking services for government

transactions, such as tax payments and pension

disbursements, as banks will remain open on

March 31, 2025

Copyright © 2021 Fintso