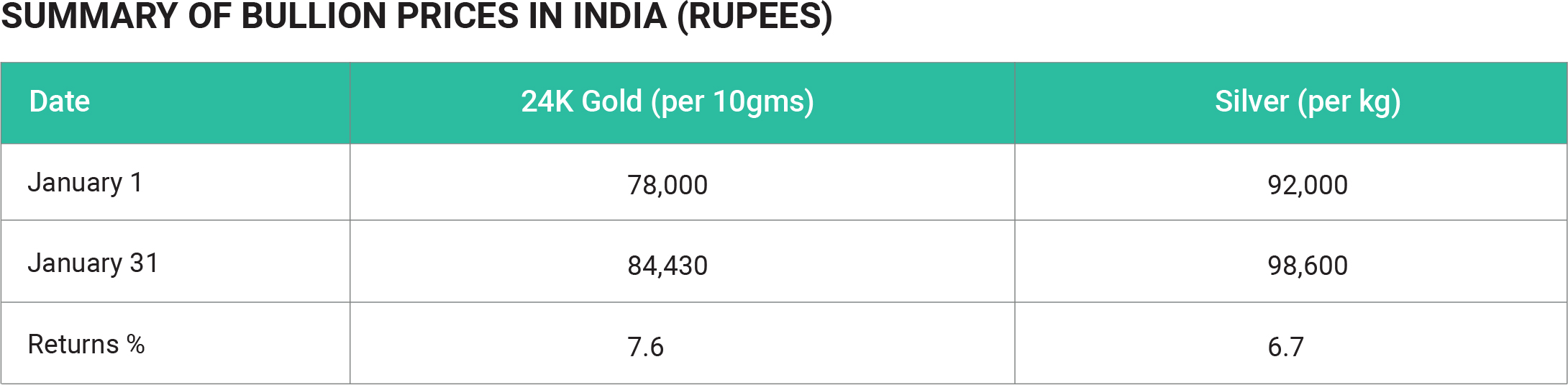

In January 2025, the bullion markets in India, which include gold and silver, experienced fluctuations influenced by various economic factors. Overall, both gold and silver showed positive returns in January 2025, with gold prices increasing by approximately 7.7% and silver by about 6.9%. Geopolitical tensions and economic instability in January 2025 drove investors toward safe-haven assets like gold and silver, boosting their prices. Heightened uncertainty of the Indian rupee against the U.S. dollar contributed to higher local prices for imported commodities, including bullion. Domestic factors also played a pivotal role in supporting bullion prices. The festive season and ongoing wedding demand in India sustained buying interest, further propping up market prices throughout the month. Looking ahead, February 2025 is expected to be dynamic in global markets fueled increased demand for these precious metals. Changes in government policies, particularly regarding import duties and trade regulations, may have positively influenced market dynamics. Persistent global inflation concerns further bolstered interest in gold and silver as investors sought protection against eroding purchasing power. Precious metals are traditionally considered effective hedges during inflationary periods. Additionally, the depreciation for the Indian bullion market. Key factors such as global economic conditions, potential interest rate decisions, Trump administration trade policies, currency fluctuations, and evolving market sentiment will likely shape the trajectory of gold and silver prices. Investors are advised to closely monitor these developments as they navigate an increasingly complex investment landscape.