In November 2024, Sensex and Nifty 50 exhibited significant volatility but ultimately closed the month with minor gains. Sensex opened at 77000 points and stayed volatile throughout the month. After touching a high of approximately 81540 points, corrections in the later week pulled it down. By the end of November Sensex closed at 80248, reflecting an overall gain of about 1,961 points or 2.54% for the month. The Nifty started at around 23,500 points and also saw ups and downs. It reached a peak of about 24,498 points before closing at 24,276.05 points at the end of November. This represented a minor gain of approximately 144.95 points or 0.60%. Indian stock markets faced global and domestic challenges this month, from US election results to weak domestic economic numbers. In early November markets began with a notable decline, as the Sensex fell sharply over 1,100 points on November 28, closing at 79,043.74, while the Nifty dipped below the 24,000 mark. This drop was attributed to various factors, including concerns over high valuations and geopolitical tensions affecting foreign portfolio investments. During the mid-month market move in the recovery phase, till the 2nd of December, the BSE Sensex had rallied by 597 points to close at approximately 79,930.70, while the Nifty gained 169 points to settle above 24,400. Key sectors contributing to this recovery included auto, banking, financial services, and metals. Looking at the sectoral front, the automobile sector and the cement sector lead the pack. The strong monthly sales growth leading by Maruti Suzuki and Mahindra & Mahindra contributed heavily towards the overall market gains. UltraTech Cement and Grasim lead the rally in the cement sector. Telecom and Pharma sectors showed resilience during the month. Notably, telecom stocks were buoyed by favourable market conditions. Banking and financial services sectors also contributed positively to market recovery towards the end of the month, buoyed by investor confidence in financial stability and growth prospects. The high volatility sectors in November were energy, IT and construction, where significant price fluctuations happened due to various market dynamics like oil prices, corporate earnings, global cues, infrastructure spending, etc. Overall, small-cap stocks outperformed both mid-cap and large-cap categories in November 2024, driven by significant gains from specific companies amidst broader market fluctuations. This trend highlights the potential for higher returns in smaller companies, although they come with increased risk and volatility compared to their larger counterparts. In the first week of November, after Trump's victory in the US

election, the Indian stock market experienced a notable rally. The BSE Sensex surged by 901.50 points (1.13%), closing at 80,378.13, while the Nifty rose by 270.75 points (1.12%) to reach 24,484.05 on November 6. This positive reaction was driven by reduced political uncertainty and expectations of pro-business policies under Trump's administration. The major sectors such as IT, realty, and oil & gas saw substantial gains, reflecting optimism about continued demand for Indian IT services amid a favourable U.S. economic environment. During the month, FIIs faced substantial outflows leading to bearish trends, DIIs capitalized on this situation with strong inflows and increased allocations in specific sectors, thereby providing some support to the market amid volatility, a similar trend was observed in October 2024 too. FIIs continued to experience significant selling pressure, with net outflows reported at approximately ₹94,017 crore in October. On November 11 alone, FII selling amounted to around ₹2,026 crore, indicating ongoing withdrawal from Indian equities. Despite the overall selling trend, FIIs increased their allocation to the Healthcare sector, raising their share from 5.62% to 6.31%. However, they reduced their investments in the Financial Services sector, decreasing their allocation from 28.18% to 27.27%. The relentless selling by FIIs contributed to significant declines in major indices like the Sensex and Nifty, as their actions directly influenced market sentiment and stock prices. In comparison to FIIs, DIIs showed resilience with net inflows of approximately ₹1,07,255 crore in October, which likely continued into November as mutual fund investments reached an all-time high of ₹41,887 crore for that month. The share of DIIs in the market rose to an all-time high of 16.46%, up from 16.25%, indicating a growing influence of domestic investors in the capital markets. Their activities provided a counterbalance to FII selling and supported overall market stability. The release of US Economic data which is stronger-than-expected consumer spending raised concerns about the Federal Reserve's interest rate policies. Investors worried that this might slow down the pace of rate cuts, which had been anticipated due to earlier economic indicators. This uncertainty contributed to a bearish sentiment in global markets, including India, as traders adjusted their expectations regarding future monetary easing. The MSCI Asia-Pacific index (excluding Japan) experienced declines due to fears surrounding U.S. monetary policy and economic conditions. Also, China's stimulus package significantly influenced foreign investment patterns in India during November 2024 by prompting a shift in focus from Indian equities to Chinese stocks. This resulted in substantial capital outflows from India and increased market volatility, highlighting the interconnectedness of global markets and investor sentiment amidst changing economic conditions. The ongoing conflicts across the globe are escalating. Significant escalations in the Russia-Ukraine conflict are, characterized by increased military involvement from North Korea, heightened U.S. support for Ukraine, and intensified hostilities leading to civilian casualties and infrastructure damage. The geopolitical landscape remained complex as international stakeholders navigated their responses amid fears of further escalation and shifting dynamics influenced by Trump leading the U.S. political front. As Iran-Iraq conflict attacks increased, Iranian-backed militias in Iraq ramped up drone attacks against Israel, claiming responsibility for at least 22 attacks in early November. On the Israel-Palestine front, military operations in Gaza continued, where Israeli forces conducted clearing operations against Hamas and other militant groups. Hezbollah launched rocket attacks from Lebanon into Israel, demonstrating the interconnectedness of regional conflicts and the potential for broader escalation. As the year ends, the last month will be a potentially eventful month for the Indian stock market, with key developments such as the RBI MPC meeting, changes in index composition, corporate results and ongoing monitoring of economic indicators likely shaping the performance of the Sensex and Nifty. Investors should remain vigilant regarding global market influences and sector-specific news that could impact trading dynamics throughout the month.

In November 2024, the Indian debt market faced significant volatility influenced by various macroeconomic factors and the outcome of the U.S. Presidential elections. The benchmark 10-year government bond yield fluctuated within a narrow range of 6.75% to 6.85% during the month. This stability followed a period of initial rallying after the Reserve Bank of India's (RBI) unexpected shift to a "neutral" monetary policy stance in October, where the repo rate was maintained at 6.50%. FII debt investments experienced outflows after substantial inflows of nearly USD 17 billion throughout 2024. This trend was largely attributed to uncertainties surrounding U.S. economic policies post-election, which influenced investor sentiment towards emerging markets like India. The re-election of Donald Trump introduced both opportunities and risks for the Indian economy and debt market. Some analysts anticipated that Trump's administration would pursue expansionary fiscal policies, potentially leading to higher inflation and interest rates in the U.S., which could adversely affect capital flows to India. The strengthening of the U.S. dollar by approximately 4% since late September exerted additional pressure on emerging markets, including India. Higher U.S. yields typically attract capital away from riskier assets, which could result in increased borrowing costs for India as investors seek higher returns elsewhere. Lastly, domestic inflation numbers were projected at around 4.2% for Q4 FY25, indicating that while inflationary pressures existed, they were manageable enough for the RBI to consider future rate cuts. However, concerns over a potential increase in the fiscal deficit due to higher government spending could keep interest rates elevated in the short term. Investors opting for shorter-duration funds are expected to offer higher yields with lower risk exposure amid changing interest rates, or investors may choose medium-long duration funds since they benefit from anticipated future rate cuts has stable economic conditions. While December 2024 would bring domestic and global challenges in the interest rate scenarios which would affect the yields in the debt market. Upcoming RBI’s MPC meeting would be less likely to introduce any immediate rate cut due to rising inflation pressures, following a surge in food prices inflation and CPI inflation rate reaching 6.2% in October 2024. On the global front, the US Fed is likely to announce a potential rate cut in December 2024 which impact global interest rates and investor sentiment towards emerging markets like India. Rising commodity prices due to geopolitical tensions or fiscal stimulus from other countries like China would further depreciate India’s inflation numbers impacting the economic conditions. December would present challenges such as rising inflation and fluctuating bond yields for the Indian debt market.

The crude oil prices experienced notable fluctuations in November 2024. In the beginning of the month, it peaked due to Middle East tensions touching approximately $80.90 per barrel. The price rise was driven by fears surrounding potential disruptions to oil supply. Mid-November, it came back to normal at $72 per barrel, as oversupply was a concern since demand weakened from China and also Libya resumed production. By late November, prices stabilized around $70 per barrel, with Brent crude priced at approximately $72.6. The prices stabilised due to cautious market sentiment as traders adjusted to the new demand forecasts and OPEC+ production strategies. Iran- Israel conflict initially spiked the prices and also the OPEC+ alliance decision to postpone planned production contributed to tighter supply. In the future oversupply will be a concern due to the anticipated unwinding of production cuts starting from January 2025. Sluggish oil demand from major consumers like China and North America played a crucial role in driving prices down. Reports indicated that Chinese refinery throughput was declining, further dampening global demand expectations. Due to uncertain factors, the Crude Oil prices would remain volatile in December 2024.

In the first week of November 2024, Gold prices rose and peaked at around Rs 78712 per 10 grams in India due to the Middle East conflict. As tension eased prices fell sharply, on the 26th price of 24-carat gold dropped to around Rs 76430 per 10 grams, and by the month's end it was trading at Rs.76500. Silver prices followed a similar trend, with initial increases due to safe-haven demand. However, by mid-November, prices declined significantly. On November 26, silver was priced at about Rs 87,930 per kilogram, down from previous highs, but end of the month it stabilised at Rs 94500 per kilogram. The major factors which have affected bullion prices are Middle East conflicts, profit-taking investors, poor US economic numbers, and lastly seasonal demands due to to wedding and festive season. December 2024 presents opportunities for both gold and silver markets amid fluctuating prices the major factors to watch for would be macroeconomic indicators and geopolitical developments around the world.

In November 2024, the Indian rupee (INR) experienced significant volatility, primarily depreciating against the US dollar. The rupee weakened to a record low of ₹84.38 against the US dollar by mid-November, marking its worst weekly fall since May 2024. This decline represented a drop of approximately 1.4% for the year up to that point, amidst a strengthening dollar and increasing global economic uncertainties. Despite this depreciation, the INR was noted as one of Asia's better-performing currencies compared to major peers like the Japanese yen and South Korean won, which fell by 8.8% and 7.5%, respectively, during the same period. November 2024 saw a significant depreciation of the Indian rupee due to a combination of external pressures from US economic policies post-election, FPI outflows, and rising global dollar strength, alongside domestic inflationary challenges. Despite these challenges, India's economic fundamentals were highlighted as relatively strong compared to other Asian economies.

In November 2024, several key market events significantly influenced mutual fund returns in India. These events were shaped by domestic and global factors, impacting investor sentiment and market dynamics. This month was characterized by a mix of geopolitical uncertainties, economic slowdowns, and shifting investor sentiment that collectively influenced mutual fund returns in India. While some funds thrived due to strong domestic inflows and sectoral performance, others struggled under the weight of external pressures and FII outflows. The Indian mutual fund industry experienced a notable increase in Assets Under Management (AUM). The AUM rose to approximately ₹68.50 trillion, reflecting a growth from ₹67.26 trillion at the end of October 2024. AUM increase can be attributed to the substantial inflows from domestic investors, with approximately ₹4.76 lakh crore invested in equity markets by late November. This influx was driven by increasing investor confidence in the equity market and strong performances from mid-cap and small-cap funds. Also the growing trend of investors opting for SIPs, which provide a disciplined approach to investing in mutual funds. Increased SIP contributions contributed positively to the overall AUM as more investors committed to regular investments. Growing awareness and understanding of financial products among Indian investors have led to increased participation in mutual funds, and regulatory measures by SEBI aimed at enhancing transparency and protecting investor interests have fostered trust in the mutual fund industry. The total SIP accounts stood at 10.12 crore and the total amount collected through SIPs was approximately ₹25,323 crore in November 2024, indicating a sustained interest in regular, systematic investments. In November 2024, the number of Systematic Investment Plans (SIPs) in the Indian mutual fund industry reached approximately 10.12 crore, reflecting a notable increase from 9.87 crore in October 2024. This represents a growth of about 25 lakh new SIP accounts added during the month. Several significant regulatory changes were implemented in the Indian mutual fund industry by the Securities and Exchange Board of India (SEBI) like prohibition of insider trading (PIT) regulations, enhanced disclosure norms, Colour-coded risk-o-meter, standardized risk change communication, regulatory changes in debt securities and lastly investment in overseas funds. These changes aimed to enhance transparency, protect investors and streamline operations within the financial markets.

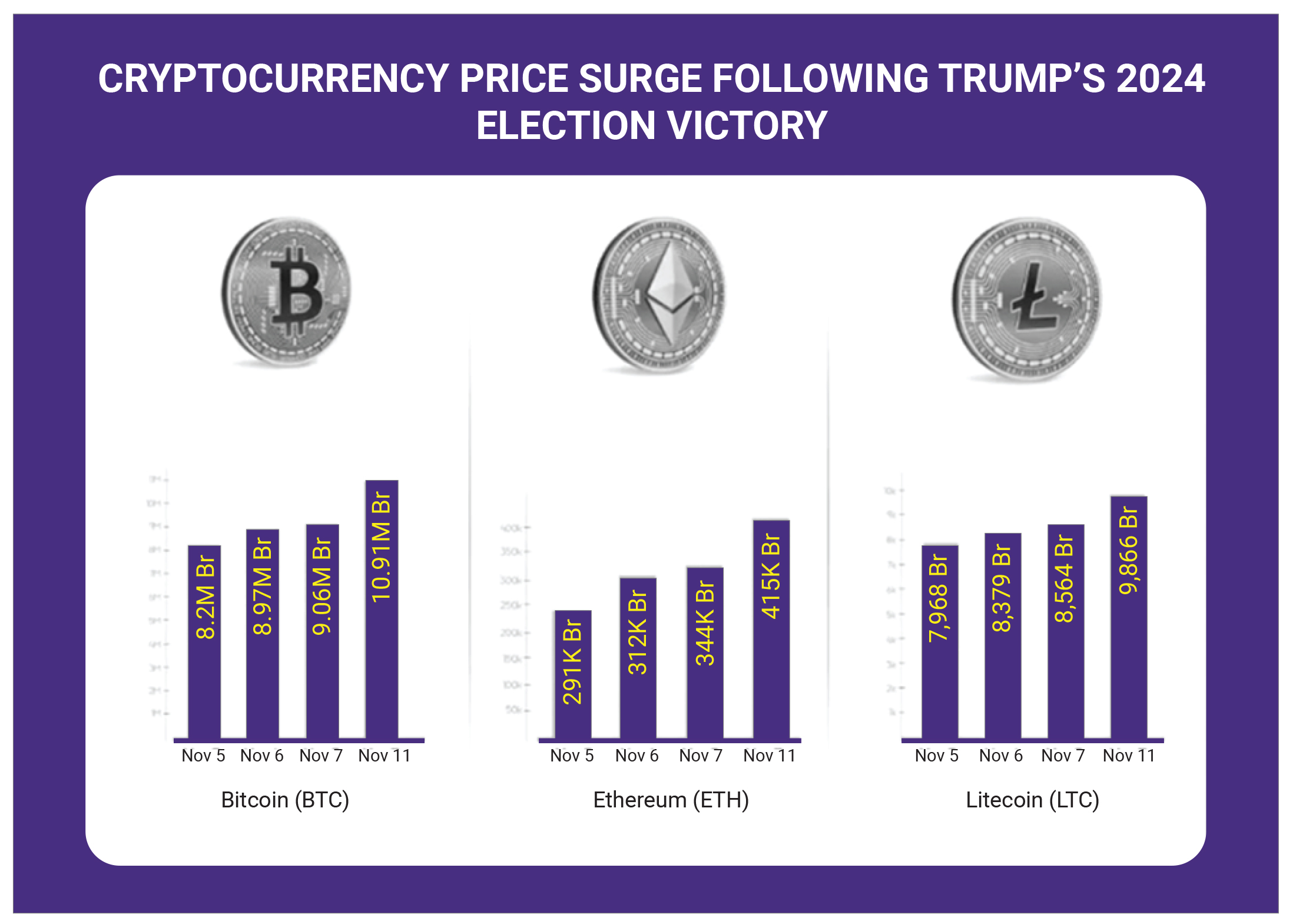

November 2024 marked a pivotal month for the Indian insurance sector, characterized by robust premium growth, significant regulatory changes aimed at enhancing market accessibility, and an increasing focus on technology-driven solutions. Life insurers reported a 13% increase in new business premiums in October 2024, despite some challenges related to surrender value regulations. The Insurance Regulatory and Development Authority of India (IRDAI) proposed lifting the current 74% cap on FDI, allowing foreign investors to own up to 100% of Indian insurance companies. The government is set to introduce the Insurance Amendment Bill during the Winter Session of Parliament, introducing several key changes, like composite insurance licenses, distribution of other financial products, reduction in capital requirements and more. The sector saw a rise in Insurtech companies, with over 150 insurtechs generating revenues exceeding $750 million. This includes approximately 10 unicorns and more than 45 minicorns, indicating a thriving ecosystem that is leveraging technology to enhance insurance offerings and customer experiences. Following data breaches in some companies like Star health, there is increased scrutiny from regulators regarding cybersecurity measures across the insurance sector, emphasizing the need for robust data protection protocols. The proposed amendments and the potential for increased foreign investment position the industry favourably for future growth as it strives towards achieving universal insurance coverage under the government's "Insurance for All by 2047" initiative. As insurers adapt to these changes, they are likely to enhance their product offerings and improve customer engagement, further driving market expansion. cryptocurrencies like Dogecoin also experienced significant price increases, indicating a broader bullish trend across the market. Speculative trading in futures markets also contributed to the rally, with investors betting heavily on Bitcoin's price climbing past $90,000. Indian cryptocurrency exchanges reported a dramatic increase in trading volumes, with some exchanges experiencing trading activity that surged 4 to 9 times compared to previous months. For instance, daily trading volumes on certain platforms reached as high as $36.5 million, up from just $5.8 million before November 6, 2024. Reports indicated that new user signups on crypto platforms increased by 4 times, and trading volume surged by 9 times compared to the previous week. This indicates a robust return of retail investors to the cryptocurrency space. While exact figures for total investments by Indian investors in cryptocurrencies for November 2024 are not specified, the substantial increase in trading volumes and user engagement suggests a significant uptick in investment activity during this period. The combination of favourable market conditions and heightened investor interest post-election has positioned the Indian cryptocurrency market for continued growth and participation from retail investors.

After Donald Trump’s victory in the US presidential elections in November 2024, cryptocurrency rallied as he promoted himself as a supporter of digital currencies, also pledged to make the US the ‘Crypto Capital of the planet’. Investors anticipated that Trump's administration would provide clearer and potentially more lenient regulations for the crypto industry. This expectation was fuelled by his promise to remove Gary Gensler, the SEC chair known for stringent oversight of cryptocurrencies, which many in the industry viewed as a barrier to growth. Bitcoin exchange-traded funds (ETFs) experienced significant inflows, with reports indicating around $1.3 billion flowed into these funds within a single day after Trump's victory. This influx is seen as a strong indicator of institutional interest and confidence in Bitcoin's future. The overall cryptocurrency market saw substantial gains, with Bitcoin reaching new all-time highs above $89,000 shortly after the election results were confirmed. Other cryptocurrencies like Dogecoin also experienced significant price increases, indicating a broader bullish trend across the market. Speculative trading in futures markets also contributed to the rally, with investors betting heavily on Bitcoin's price climbing past $90,000. Indian cryptocurrency exchanges reported a dramatic increase in trading volumes, with some exchanges experiencing trading activity that surged 4 to 9 times compared to previous months. For instance, daily trading volumes on certain platforms reached as high as $36.5 million, up from just $5.8 million before November 6, 2024. Reports indicated that new user signups on crypto platforms increased by 4 times, and trading volume surged by 9 times compared to the previous week. This indicates a robust return of retail investors to the cryptocurrency space. While exact figures for total investments by Indian investors in cryptocurrencies for November 2024 are not specified, the substantial increase in trading volumes and user engagement suggests a significant uptick in investment activity during this period. The combination of favourable market conditions and heightened investor interest post-election has positioned the Indian cryptocurrency market for continued growth and participation from retail investors.

Copyright © 2021 Fintso